Homeowners Don’t Want to Sell, So the Market for Brand-New Homes Is Booming

High mortgage rates are dissuading sellers, leaving new construction the only game in town; ‘there was no inventory’

LEHI, Utah—After mortgage rates shot up last year, Ivory Homes, one of Utah’s largest builders, suddenly had few buyers for the hundreds of homes it had under construction. So Clark Ivory, the chief executive, laid off 9% of his staff, and by January he had slashed construction by nearly 80% from its 2022 peak.

Then, much to his surprise, sales of new homes started picking up. By May, even though mortgage rates weren’t really budging, sales for all home builders were at their highest level since early 2022.

Millions of American homeowners have been reluctant to sell because they can’t afford to give up the low mortgage rates they have now. Only 1.08 million existing homes were for sale or under contract at the end of May, the lowest level for that month in National Association of Realtors data going back to 1999.

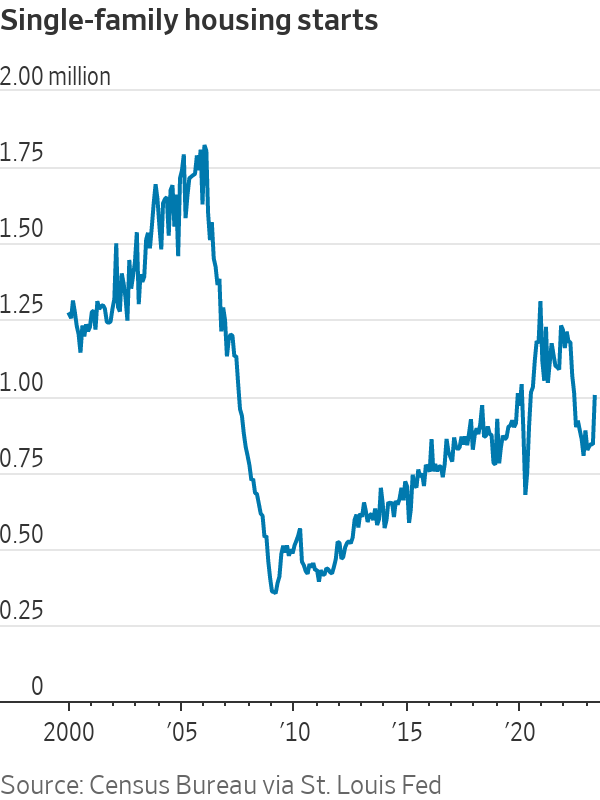

For many would-be buyers—in Utah and in many other markets—new construction has become the only game in town. Newly built homes accounted for nearly one-third of single-family homes for sale nationwide in May, compared with a historical norm of 10% to 20%. Existing-home sales in May fell 20% year-over-year, while new single-family home sales that month rose 20% on an annual basis.

That divergence is yet another example of how this housing market is behaving like no other. “It’s such a rare thing,” said Rick Palacios Jr., director of research at Irvine, Calif.-based John Burns Research & Consulting, who predicts the disparity will widen in coming months.

So far, the home-building revival, coupled with financial incentives offered by builders, is providing only minor relief to prospective buyers. Builders aren’t erecting enough homes to offset the shortage of existing ones on the market, meaning buyers in many places still face bidding wars. On a national basis, home prices have only declined a small amount from their record highs in spring 2022. Interest rates have risen in recent weeks to their highest level this year.

For builders like Ivory, though, it has been a lifeline. Builder confidence, which declined every month in 2022, has risen for seven straight months to its highest level since June 2022, according to the National Association of Home Builders.

Investors believe the home-building industry—one of the most sensitive to changes in interest rates—has already gone through its recession and is coming out the other side

Publicly traded home builders have reported stronger-than-expected results this year. The S&P Homebuilders Select Industry stock index is up 39.8% this year as of Tuesday’s close, outpacing the S&P 500’s 18.6% gain. Share prices for D.R. Horton, Lennar and PulteGroup, the three largest home builders, have performed even better.

The pandemic stoked an especially broad housing boom in 2020 and 2021. Many buyers sought larger spaces to spend more time at home, while others wanted to move closer to family. Ultralow interest rates made it inexpensive to finance their purchases.

Home-building activity surged. Mountain West states such as Utah became an attractive destination during the pandemic for people leaving expensive West Coast cities in search of a lower cost of living and an outdoors lifestyle. Home prices in the Salt Lake City area soared 53% between January 2020 and May 2022, on a seasonally adjusted basis, according to Freddie Mac’s home-price index.

Family-owned Ivory Homes, which was founded by Ivory’s father, Ellis Ivory, has been one of Utah’s top home builders for decades. Clark Ivory, 58 years old, became CEO in 2000.

In 2006, around the peak of the last boom, Ivory got worried about speculative investing. Ivory Homes started buying less land and paying off debt. To avoid selling to flippers, the company required buyers to sign an agreement that they were purchasing their homes as primary or secondary residences and that they wouldn’t sell for at least a year.

U.S. home prices fell 27% between mid-2006 and early 2012, sending ripples throughout the global economy and world financial markets. Ivory Homes stayed profitable between 2008 and 2012, Ivory said.

The pandemic-driven housing boom, Ivory said, didn’t involve as much speculation. Lending standards have improved, and investors have been buying homes to rent out to tenants, not to flip. During the pandemic boom, builders also faced obstacles they didn’t last time around, which kept them from overbuilding: supply-chain issues and labor shortages added weeks or months to their construction timelines. Ivory said his biggest concern, however, is affordability.

In the spring of 2022, rapidly rising mortgage rates abruptly slowed buying. Prices in Utah and around the U.S. had risen so rapidly that many buyers were priced out.

“It was the third weekend in May last year, and literally the lights just turned off,” said Ryan Smith, president of home building for Denver-based Oakwood Homes, a unit of Berkshire Hathaway that builds in Colorado, Utah and Arizona. “From there, the fight was on” to keep buyers from canceling.

Ivory Homes had 1,089 homes under construction in last year’s first quarter, including 513 that hadn’t yet been sold. “If I made one big mistake in the way I managed through Covid, it was trying to keep up” with demand, Ivory said. “I should have said to myself, ‘We can’t handle this.’ ”

In the second half of 2022, builders cut prices to attract buyers for their unsold homes or to persuade buyers already under contract not to back out.

Demand rebounded this year in the first quarter. By April, builders forecast a 7% increase in sales for 2023, according to a survey by John Burns Research & Consulting, reversing their forecast of a 9% drop when surveyed in November.

In Daybreak, a master-planned community about a 30-minute drive from Salt Lake City, developer Larry H. Miller Real Estate initially expected to sell 100 to 125 lots this year to home builders, including Ivory Homes. Now it expects to sell 160, according to Brad Holmes, the developer’s president.

“There was no inventory on the existing market, so everybody was being pushed to a new home,” he said.

Ivory Homes has adjusted its building plans to meet current buyers’ tastes and budgets. It is building in a master-planned community called Holbrook Farms in Lehi, a fast-growing city about 30 miles south of Salt Lake City. Lehi and nearby communities are home to the area’s many tech businesses—a major market for Ivory Homes and other builders.

Last fall, Ivory Homes was building three-story homes with three or four bedrooms in Holbrook Farms to sell for up to $625,000. Called E-Villas, they had open kitchens and were targeted at first-time buyers.

As demand slowed late last year, Ivory said, the company decided: “We have to hit a lower price point.” It redesigned the E-Villas to offer a two-story version with three bedrooms, priced below $450,000.

Now the two-story homes are now selling better than the three-story ones, he said.

Builders nationwide are focusing on cutting costs and building smaller homes with lower price tags. Nationally, the proportion of new homes sold in May for under $300,000 rose to 17%, the highest level since December 2021.

Home builders also began offering sweeter terms to buyers. About 52% of builders provided incentives in July, up from 43% in July 2022, according to a NAHB survey. Many builders are paying to lower buyers’ mortgage rates, often by a percentage point or more, to help make the monthly payments more affordable.

Some buydowns reduce rates for only the first few years of a loan, but many builders, including Ivory Homes, are offering to lower the mortgage rate for the life of the loan. The temporary buydowns require buyers to qualify for the highest mortgage rate the loan will reach.

The arrangements benefit buyers and sellers alike. Builders would rather pay for lower mortgage rates than cut prices, because price cuts can affect the value of other homes in the neighbourhood. For buyers, a lower mortgage rate can reduce a monthly payment more than a price cut.

Salt Lake City housing prices aren’t rising at the frenetic pace of 2021 and early 2022. In June, average new-home prices in the metro area fell 11% from the year-earlier period, factoring in the value of incentives, according to a John Burns Research & Consulting survey.

First-time home buyers that tour Holbrook Farms are factoring in a mortgage rate of nearly 7%, according to John Savage, an Ivory Homes sales consultant. With a rate buydown from the builder, their purchasing power can go up by $100,000, he said.

Katherine Luke and Muhammad Salman had been looking to buy their first home in the Salt Lake City area for more than two years. They didn’t find many existing homes on the market within their budget that didn’t need renovations. Earlier this year, they started looking at new homes instead.

“For the price point, it does seem like it makes more sense than trying to renovate an older home,” Luke said. There is more to choose from in the new-home market, she said.

The couple bought a new four-bedroom house from Ivory Homes in early July for about $600,000. They opted for a temporary buydown that reduces their mortgage rate for the first two years of the loan, and they hope to refinance to a lower rate as soon as they can.

“I’m hoping we made the right decision,” Luke said. “I don’t know if it was the right time to buy, but rents keep going up.”

Buyers remain sensitive to small changes in mortgage rates, and an increase in the average to above 7% could slow demand, builders say. The average rate for a 30-year fixed mortgage was 6.96% in the week ended July 13, the highest since November, according to Freddie Mac. A recession, higher unemployment or uncertainty about the presidential election also could spook buyers.

Some regional and local banks have been tightening credit for small businesses, which could also threaten some builders’ ability to borrow money for new projects. And while builders’ costs have come down somewhat, largely due to a big decline in lumber prices, they are still higher than pre pandemic levels. Federal student-loan payments are set to resume in the fall, which could make it more difficult for first-time home buyers to save for down payments.

Yet others who delayed their home-buying plans in 2022 have grown comfortable with current mortgage rates, real-estate agents and builders say.

“People still need a house, because they got married last year, they graduated college last year, and they’re tired of waiting,” said Barry Gittleman, chief executive of Murray, Utah-based builder Hamlet Homes.

And after two years of robust home sales and high margins during the recent housing boom, builders can afford to keep offering rate buydowns to entice buyers.

“We’re all relieved now that we had a really good first half of the year,” Ivory said. “This is not a market to be scared about.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The Republican nominee says it would help bring down home prices, though these buyers account for a fraction of U.S. home sales

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments Thursday during a policy speech to the Economic Club of New York in Manhattan.

Housing remains a top economic issue for voters during this presidential election. Rent and home prices grew at historic rates during the pandemic and mortgage rates climbed to levels not seen in more than two decades. A July Wall Street Journal poll showed that voters rank housing as their second-biggest inflation concern after groceries.

Both major candidates for the 2024 presidential election have made appeals to voters on housing during recent campaign stops, though the issue has so far featured more prominently in Vice President Kamala Harris ’s campaign.

Trump has blamed immigrants for many of the nation’s woes, including crime and unemployment. Now, he is pointing to immigrants as a cause of the nation’s housing-affordability crisis. Yet some affordable-housing advocates and real-estate professionals said Trump’s mortgage proposal would fail to bring relief to priced-out home buyers.

“It’s unfortunate that given the significant housing affordability crisis that is widely acknowledged across most partisan lines, we are arguing about a minuscule segment of the market,” said David Dworkin, president of the National Housing Conference, an affordable-housing advocacy group.

Gary Acosta, chief executive of the National Association of Hispanic Real Estate Professionals, a trade organization, said, “It’s just another effort to vilify immigrants and to continue to scapegoat them for any issues that we have here in the United States.”

A Trump campaign spokeswoman didn’t immediately respond to a request for comment.

Undocumented immigrants in the U.S. can obtain an obscure type of mortgage designed for taxpayers without Social Security numbers, most of whom are Hispanic. The passage of the USA Patriot Act of 2001 allowed banks to use identification numbers from the Internal Revenue Service as an alternative to Social Security, extending a number of financial services to people without legal status for the first time.

Mortgage loans for undocumented immigrants are typically higher interest and borrowers include legal residents who have undocumented spouses, Acosta said. Lenders include regional credit unions and community-development financial institutions.

In his speech, Trump said that “the flood” of undocumented immigrants is driving up housing costs. “That’s why my plan will ban mortgages for illegal aliens,” he said.

Trump didn’t elaborate on how he would enact a ban on such loans.

Though mortgages for undocumented people living in the U.S. are relatively rare, residential real-estate purchases by foreign nationals are big business , especially in expensive coastal cities such as New York and Los Angeles. These sales have declined in recent years, however.

Close to half of foreign purchases are made by people residing abroad, while the other half are made by recent immigrants or residents on nonimmigrant visas, according to an annual survey by the National Association of Realtors. Many affluent foreigners buy U.S. homes with cash instead of obtaining mortgage financing.

In his Thursday speech, which focused mostly on other economic matters such as energy and taxation, Trump proposed other measures to bring down housing costs, including cutting regulations for builders and allowing more building on federal land. Similar ideas appeared in the housing policy outline Harris released in August .

The former president has spoken on housing-related issues in speeches at other recent campaign stops, including in Michigan last month, where he touted his administration’s 2020 overturn of a policy that had encouraged cities to reduce racial segregation .

“I keep the suburbs safe,” Trump said. “I stopped low-income towers from rising right alongside of their house. And I’m keeping the illegal aliens away from the suburbs.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.