Hong Kong’s Property Market Is a Mess—and the Fed Is Partly to Blame

U.S. rate increases have tamed inflation at home but caused pain elsewhere

Hong Kong’s notoriously expensive property market is often seen as a barometer of the city’s economy. It isn’t looking good.

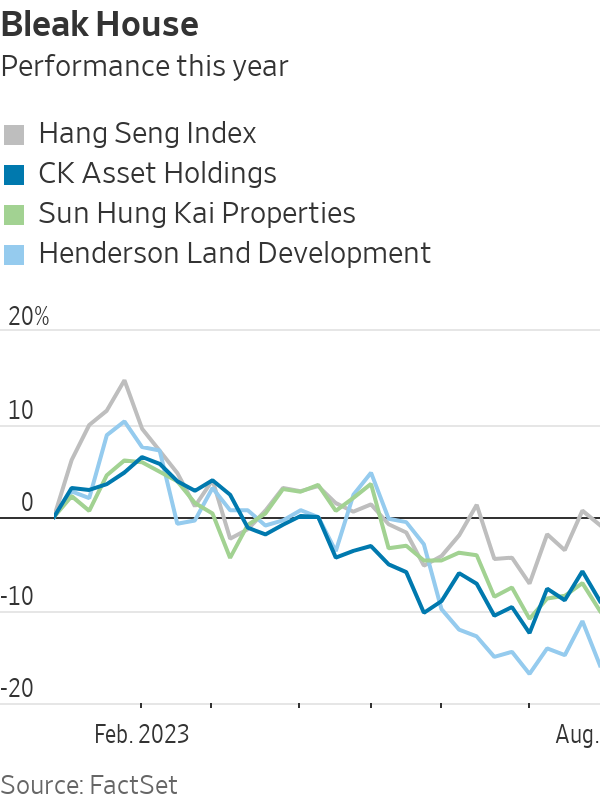

Home prices are down. Office vacancy rates have hit a record high. Commercial real-estate investment has plummeted. The shares of some big developers in the city are trading at a 30-year low to their net asset value, a measure of financial health, according to research by analysts at JPMorgan.

A key reason is high interest rates, which have increased the burden on mortgage-paying home buyers, said Cathie Chung, senior director of research at Jones Lang LaSalle, a real-estate services company. The Hong Kong dollar’s peg to the U.S. dollar forces monetary authorities in the city to track U.S. interest-rate decisions, limiting their ability to stimulate the property sector and the wider economy.

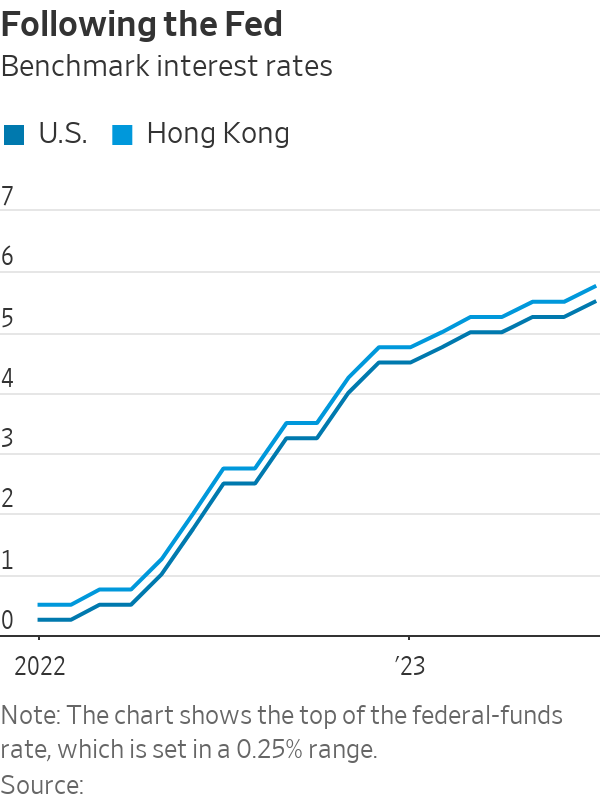

The Federal Reserve has embarked on a historic cycle of interest-rate rises since last March, raising the benchmark federal-funds rate from around zero to 5.25% to 5.50%. The Hong Kong Monetary Authority, the city’s de facto central bank, has followed these hikes, increasing its base rate to 5.75% from 0.75% over the same period.

The full impact of higher interest rates in the city still hasn’t been felt, said Asif Ghafoor, chief executive of online real-estate marketplace Spacious. Asking prices of residential properties listed on the platform have fallen 5% since the start of the year. Sales prices tend to follow suit, and are likely to fall 5% to 10% in the next six months, he said.

To prop up the market, the HKMA relaxed mortgage rules in early July for the first time since 2009, allowing home buyers to pay less upfront and borrow more for some properties if they plan to live in them. But those working in the sector think the pain is far from over.

“We expect that the recovery will be slow and long,” said Chung at Jones Lang LaSalle.

The slump in the property market has hurt the share prices of developers, a major source of wealth for some of the city’s richest families. CK Asset Holdings, Henderson Land Development, Sun Hung Kai Properties and New World Development—all still partly owned by the families of the founders—are performing much worse than the wider stock market this year. New World and Henderson Land have lost more than 15% this year, according to FactSet data.

Hong Kong is one of the world’s leading financial centres and is seen by many foreign businesses as a gateway to mainland China. It is now being hit by a slowdown in investment-banking activity—with several large banks cutting staff this year—and the shaky recovery of China’s economy, which has undermined confidence among businesses and potential home buyers in Hong Kong.

The overall vacancy rate for offices reached a record high of 15.7% in the first half of this year, compared with an average of under 5% in 2018, according to figures by CBRE. In the central business district, there was almost eight times as much empty office space as in 2018, when the area had a vacancy rate of just 1.3%.

The equivalent of $603 million was invested in commercial real estate between April and June, according to CBRE data, just a third of the first-quarter tally and the lowest quarterly figure since the end of 2008, when the global financial crisis caused a huge drop in confidence.

Hong Kong’s border with mainland China was reopened earlier this year, but companies from the mainland haven’t grabbed office space in the numbers many had hoped, said Ada Fung, head of office services at CBRE Hong Kong. Flexible working arrangements and geopolitical tensions that have made many companies pause expansion plans are also crimping demand, she said.

The drop in demand is being exacerbated by a supply glut. Developers bought land and started constructing a number of new buildings before 2019, when widespread protests rocked the city and only ended with the passing of a strict national-security law. Demand for commercial property after that was soon undermined by the spread of Covid-19.

This shift in supply and demand is finally giving potential renters the upper hand, said Fung. “It could be a healthy reset,” she said.

There are some reasons for optimism. Retail businesses have increased their demand for commercial property after the reopening of the border with China, which has brought in tourists looking to spend on luxury goods. There is also hope that a recent rise in residential rents could help home prices.

After an exodus of professionals and other residents in recent years, people have started to move to the city, including foreign students and those coming to Hong Kong through government talent schemes designed to reverse a brain drain. That is helping rents pick up after hitting a bottom in the first quarter, and could lead to more demand for properties as investments, said Cusson Leung, head of property research in Hong Kong at JPMorgan.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

While the vast majority of sellers enjoyed a profit, in some parts of Australian cities others are licking their wounds

The Australian property market has recorded 17 consecutive months of growth overall, as limited supply and high demand in most markets continue to trump the impact of higher interest rates. The median Australian home value lifted 8 percent over FY24, but not every part of the market is strong.

The profitability of resold properties provides an insight into how home or investment property ownership can go right and wrong, with a key factor being the length of time the asset is held. CoreLogic’s latest Pain and Gain report reveals 94.3 percent of 85,000 resales in the March quarter sold at a profit. That’s the highest rate of profitability since July 2010 and reflects recent strong selling conditions in most markets except Victoria and Tasmania.

The median gain per profitable resale was $265,000. Houses were more likely to resell at a profit, with 97.1 percent of house resales profitable compared to 89 percent of apartment resales. The flipside to the data is 5.7 percent of all resales resulted in a loss. The median amount of that loss was $40,000, however, that’s just in the value of the property. It does not factor in the significant costs of buying the property, such as stamp duty; nor the selling costs, such as the agents’ fee.

CoreLogic’s Head of Research Eliza Owen said short-term resales indicate how households are responding to higher interest rates. According to the report: “The two-year resales trend seems to have peaked in the year to August 2023, roughly two years after the peak in fixed term borrowing back in 2021. This data suggests the sticker shock from higher mortgage rates may have had some influence on decisions to sell more property than otherwise would have transacted after a short hold period.”

The median hold period of all resold homes was 8.8 years in the March quarter. “Time in the market rather than timing the market is critical to maximising returns for most resales,” Ms Owen said. “Generally, the longer a vendor holds a property the higher the returns, with vendors selling after 30 or more years attracting the largest median gain of $780,000.” By comparison, the median gain among profitable resales that occurred within two years of purchase was $82,000.

Within the top 20 local government areas (LGAs) of each capital city where the highest proportion of loss-making sales occurred, a common theme was shorter hold periods for the loss-making sales compared to the profit-making sales in 14 of those 20 areas.

Here are the top 20 capital city LGAs for the most loss-making sales in the March quarter.

Melbourne LGA

Loss-making sales totalled 38.9 percent of all resales in Melbourne. The median hold period among loss-making sales was 9.8 years and the median capital loss was $54,500.

Perth LGA

Loss-making sales totalled 38.4 percent of all resales in Perth. Vendors who sold at a loss held their properties for a median of 11.5 years and the median loss was $54,000.

Darwin LGA

Loss-making sales totalled 33.6 percent of all resales in Darwin. The median hold period among loss-making sales was 10.4 years and the median capital loss was $70,000.

Stonnington LGA, Melbourne

Loss-making sales totalled 29.8 percent of all resales in Stonnington. Home or investment owners who sold at a loss held their properties for a median of nine years. The median loss was $57,000.

Palmerston LGA, Darwin

Loss-making sales totalled 26.5 percent of all resales in Palmerston, which is a satellite city to Darwin. The median hold period among loss-making sales was 10.2 years and the median loss was $82,000.

Parramatta LGA, Sydney

Loss-making sales totalled 25.3 percent of all resales in Parramatta. The median hold period among loss-making sales was 7.8 years and the median capital loss was $49,750.

Yarra LGA, Melbourne

Loss-making sales totalled 24.7 percent of all resales in Yarra. Owners who sold at a loss held their properties for a median of 8.2 years. The median loss was $40,000.

Port Phillip LGA, Melbourne

Loss-making sales totalled 23.9 percent of all resales in Port Phillip. Vendors who sold at a loss held their properties for a median of 8.7 years and the median capital loss was $42,000.

Strathfield LGA, Sydney

Loss-making sales totalled 22.8 percent of all resales in Strathfield. The median hold period was 7.4 years and the median loss was $60,000.

Ryde LGA, Sydney

Loss-making sales totalled 22.4 percent of all resales in Ryde. The median hold period among loss-making sales was 7.8 years. The median capital loss was $51,500.

Burwood LGA, Sydney

Loss-making sales totalled 20.9 percent of all resales in Burwood. Home or investment owners who sold at a loss held their properties for a median of just 5.3 years and the median loss was $63,500.

Vincent LGA, Perth

Loss-making sales totalled 20.5 percent of all resales in Vincent. The median hold period among loss-making sales was 10.2 years. The median loss was $40,000.

Maribyrnong LGA, Melbourne

Loss-making sales totalled 20.4 percent of all resales in Maribyrnong. The median hold period was 6.7 years and the median capital loss was $37,250.

Boroondara LGA, Melbourne

Loss-making sales totalled 19.7 percent of all resales in Boroondara. Property owners who sold at a loss held their assets for a median of 9.1 years and the median loss was $40,000.

Moonee Valley LGA, Melbourne

Loss-making sales totalled 17.9 percent of all resales in Moonee Valley. The median hold period was 7.3 years. The median capital loss was $41,000.

Belmont, Perth

Loss-making sales totalled 17.4 percent of all resales in Belmont. The median hold period among loss-making sales was 10.1 years and the median loss was $35,000.

Cumberland LGA, Sydney

Loss-making sales totalled 15.4 percent of all resales in Cumberland. Home or investment owners who sold at a loss held their properties for a median of 7.2 years. The median loss was $35,000.

Subiaco LGA, Perth

Loss-making sales totalled 14.3 percent of all resales in Subiaco. The median hold period among loss-making sales was 10 years and the median loss was $50,000.

Victoria Park LGA, Perth

Loss-making sales totalled 13 percent of all resales in Victoria Park. The median hold period was 10.2 years. The median capital loss was $42,500.

Sydney LGA

Loss-making sales totalled 12.6 percent of all resales in Sydney. The median hold period among loss-making sales was 7.2 years and the median loss was $57,000.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.