Big Tech Is Downsizing Workspace in Another Blow to Office Real Estate

Pullback marks a sharp reversal after years when companies had been bolstering their office footprints

Big technology companies are cutting back on office space across major coastal cities, leaving some exposed landlords with empty buildings and steep losses.

The pullback marks a sharp reversal after years when companies such as Amazon.com , Meta Platforms ’ Facebook and Google parent Alphabet had been bolstering their office footprints by adding millions of square feet of space.

Their expansion continued even after the pandemic erupted and many employees started working remotely. Tech companies have been the dominant tenant in West Coast cities like Seattle and San Francisco, and by 2021 these companies came to rival those in the finance industry as Manhattan’s biggest user of office space .

Now, big tech companies are letting leases expire or looking to unload some offices. Amazon is ditching or not renewing some office leases and last year paused construction on its second headquarters in northern Virginia. Google has listed office space in Silicon Valley for sublease, according to data company CoStar . Meta has also dumped some office space and is leasing less than it did early on in the pandemic.

Salesforce , the cloud-based software company, said in a recent securities filing that it leased or owned about 900,000 square feet of San Francisco office space as of January. That is barely half the 1.6 million of office space it reported having in that city a year earlier.

Tech giants looking to unload part of their workplace face a lot of competition. Office space listed for sublease in 30 cities with a lot of technology tenants has risen to the highest levels in at least a decade, according to brokerage CBRE . The 168.4 million square feet of office space for sublease in the first quarter was down slightly from the fourth-quarter 2023 peak but up almost threefold from early 2019.

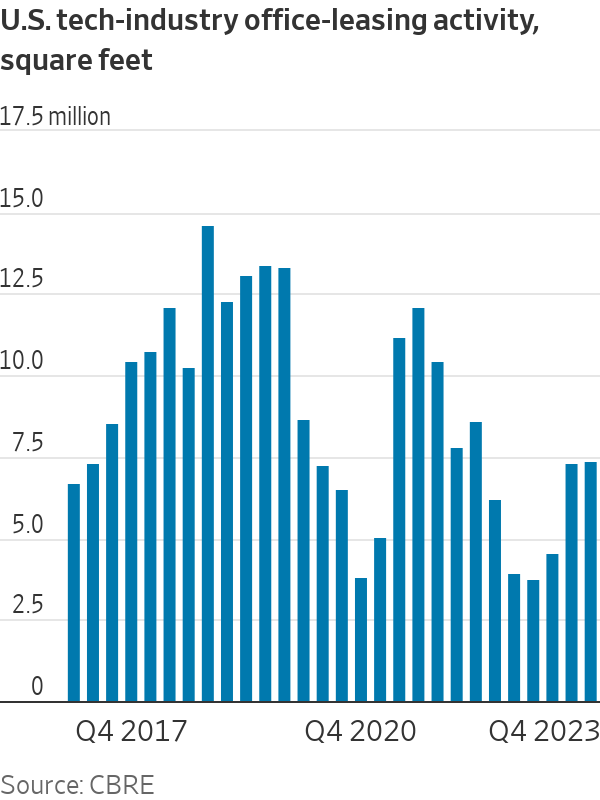

Even tech companies that are renewing or adding space want less than they did before. The amount of new office space tech companies leased fell by almost half in the fourth quarter of last year compared with 2019, CBRE said.

Tech’s voracious appetite for office and other commercial real estate had been an economic boon for cities. The new workspace usually brought an influx of well-paid employees, boosted cities’ property-tax revenue and translated into more business for local retailers and shop owners.

Now, the waning appetite is a blow to cities at a time when it is difficult to find other big tenants. For landlords already grappling with higher interest rates and a drop in demand from financial companies, law firms and other tenants, tech’s reversal is especially painful.

In some cases, tech’s softening demand can lead to plunging real-estate values. Take 1800 Ninth Avenue, a 15-story office building in Seattle. Amazon’s rent payments helped almost triple the building’s value in the decade after the 2008-09 financial crisis.

In 2013, Amazon moved into about two-thirds of the building. At the end of that year, the building sold for $150 million—almost double the $77 million it had sold for just two years earlier.

Its price kept climbing as strong demand from tech companies and low interest rates drew big investment firms into the Seattle commercial-real-estate market. In 2019, J.P. Morgan Asset Management bought the building for $206 million.

Amazon’s lease expires this year, and the company is moving out. The building is listed for sale. It is expected to sell for about a quarter of its 2019 price, according to estimates by real-estate people familiar with the property.

“We’re constantly evaluating our real-estate portfolio based on the dynamic and diverse needs of Amazon’s businesses by looking at trends in how employees are using our offices,” an Amazon spokeswoman said in a statement.

When the pandemic upended the U.S. office market, large tech companies were initially a bright spot. They continued adding space, betting they would eventually need it as they hired more people and as employees gradually returned to the office.

“Big tech was pretty resilient,” said Brooks Hauf , a senior director at brokerage Avison Young.

That changed in 2022. Remote work continued to be popular, and some big tech companies laid off workers , meaning they needed less space than they had thought, said Colin Yasukochi , an executive director at CBRE’s Tech Insights Center.

Leasing by tech companies fell by about half between the third quarter of 2021 and the third quarter of 2022, according to CBRE.

Since then, companies tied to the booming artificial-intelligence business have leased more space in San Francisco and other cities. But that hasn’t been enough to meaningfully boost the office market. San Francisco’s office-vacancy rate hit a record 36.7% in the first quarter, according to CBRE, up from just 3.6% in early 2019.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The harbourfront estate has views of the Sydney Opera House and can entertain up to 500 guests

A Sydney waterfront mansion that has just hit the market could set a countrywide price record as the first home to sell for A$200 million (US$129.77 million).

Located in the affluent suburb of Point Piper, the sprawling home sits on a lot that’s equivalent to “four normal housing blocks” and features 98 meters (321.5 feet) of water frontage along the harbor, according to an announcement on Wednesday from Ken Jacobs, director of Australia Pacific of Forbes Global Properties, who has the listing in association with real estate agent Brad Pillinger.

“The estate is Australia’s most iconic residence and ranks amongst the best in the world, combining both privacy and space, exuding elegance and comfort, while featuring gun-barrel views of the Sydney Opera House and the Harbour Bridge,” Jacobs said in a statement.

The residence is expected to sell for A$200 million or more, Pillinger added. “There is no comparable property in Australia.”

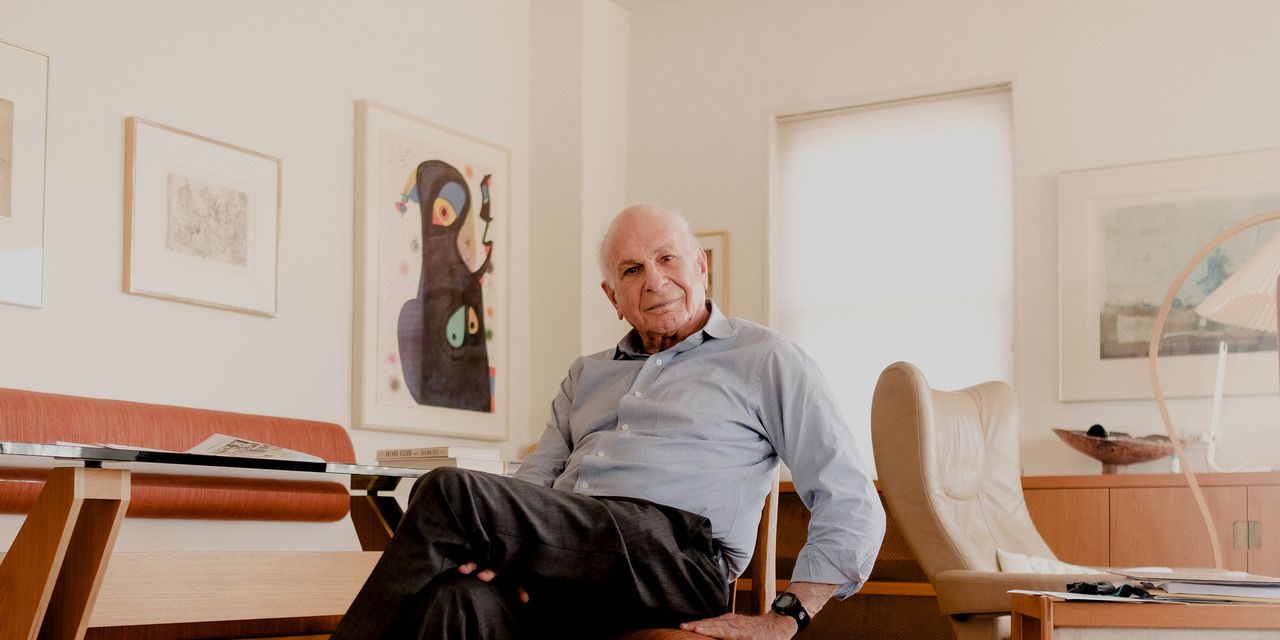

The home, named Wingadal, as it’s located on Wingadal Place, was built for Aussie Home Loans founder John Symond, who purchased the property in 1999. It took eight years to complete the mansion, which was designed by architect Alec Tzannes, according to the listing agency.

“Wingadal is a highlight of my career in residential design and architecture,” Tzannes said. “The timeless design on the Point Piper peninsula offers a unique appreciation of Sydney Harbour from a variety of angles, rotating around an axis that lines up perfectly with the Sydney Harbour Bridge.”

The colossal home has enough internal space to entertain up to 500 people, and underground parking provides space for 20 cars, plus eight more can fit inside the garage.

The four-level home has four bedrooms as well as a two-bedroom apartment. There’s also a 2,500-bottle wine cellar, a home theater that seats 22, two commercial kitchens and a swimming pool.

“Wingadal has been a special home for my family over the past two decades, and now I’m looking forward to spending more time traveling overseas,” Symond said in a statement. “While being an exceptional family home, we have also enjoyed hosting many important events for charities and other worthwhile causes.”

This is not the first time Symond has tried to sell his waterfront estate. In 2016, he listed the home in hopes of selling it for at least A$100 million, which would’ve been a price record for the country at that time Mansion Global reported . The current benchmark was set in 2022, when a baronial-style estate, also in Point Piper, sold for A$130 million, according to The Sydney Morning Herald .

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.