People Without Kids Are Leaving Money to Surprised Heirs

The bequests benefit charities, distant relatives and even pets

Charities, distant relatives and even pets are benefiting from surprise inheritances. They can thank people without children.

Not having children is becoming more common, both among millennials and older people. A July Pew Research Center analysis found that 20% of U.S. adults age 50 and older hadn’t had children.

And many of these people don’t have wills. An AARP survey found half of childless people age 50-plus who live alone have a will, compared with 57% of others that age. Those without wills have less control over what happens to their money, which often ends up in the hands of people who don’t expect it.

This phenomenon of a surprise inheritance is common enough that it has a name: the laughing heir .

“All they do is get the money and go, ‘Ah ha ha, look at that,’ ” said Michael Ettinger , an estate lawyer in New York.

Kelley Gilpin McKeig, a 64-year-old healthcare-industry consultant in Ridgefield, Wash., received a phone call several years ago saying her cousin Nick Caldwell left behind money in a savings account. They hadn’t been in touch for 20 years.

“I thought it was a scam,” she said. “Nobody else in our family had heard that he had passed.”

She hunted down his death certificate and a news article and learned he had died about a year and a half before in a workplace accident.

Caldwell, who was in his 50s, had died without a will. His estate was split among cousins and an uncle. It took about two years for the money to be distributed because of the paperwork and court approval involved. Gilpin McKeig’s share was $2,300.

Afterward, she updated her will to make sure what she has doesn’t go to “just anybody down the line, or cousins I don’t care about.”

Who inherits

There are trillions of dollars at stake as baby boomers age.

Most people leave their money to spouses and children when they die. A 2021 analysis of Federal Reserve survey data found that 82% of heirs’ inheritances came from parents.

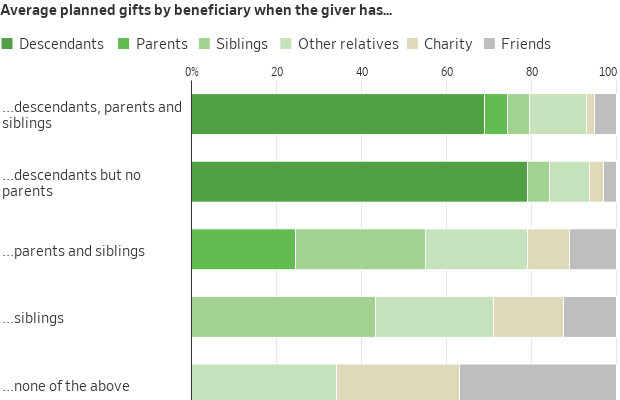

People with no children say they want to leave a greater share of their estates to charity, friends and extended family , according to research by two Yale law professors that surveyed 9,000 U.S. adults.

Rebecca Fornwalt, a 33-year-old writer, created a trust after landing a book deal. While her heirs are her parents, her backup heirs include her sister and about a half-dozen close friends. She set aside $15,000 for the care of each of her two dogs.

Susan Lassiter-Lyons , a financial coach in Florence, Ariz., said one childless client is leaving equal interests in her home to her two nephews. Another is leaving her home to a man she has been friends with for a long time.

“She broke his heart years ago and she feels guilted into leaving him property,” Lassiter-Lyons said.

A client who is a former escort estranged from her family is leaving her estate to two friends and to charity.

Lassiter-Lyons, who doesn’t have children, set up a trust for her two dogs should she and her wife die. The pet guardian, her wife’s sister, would live in their house while taking care of the dogs. When the dogs die, she inherits the house.

In the Yale study, people without descendants—children or grandchildren—intended to give 10% of their estates to charity, on average, more than triple the intended amount of those with descendants.

The Jewish Community Foundation of Los Angeles, which manages $1.3 billion of assets, a few years ago added an “heirless donors” section to its website that profiles donors and talks about building a legacy.

“Fifteen years ago, we never talked about child-free donors at all,” said Lew Groner , the foundation’s vice president for marketing.

In the absence of a will, heirs are determined by state law . Assets can wind up in the state’s hands. In New York, for example, $240 million in unclaimed funds over the past 10 years has arrived from estates of the deceased, not including real estate, according to the state comptroller’s office. In California, it is $54.3 million.

Hard questions

Financial advisers say a far bigger concern than who gets what is making sure there is enough money and support for a comfortable old age, because clients without children can’t call on them for help.

“I hope there is something left to leave,” said Stephanie Maxfield, a 43-year-old therapist in southern Colorado. “But if there isn’t, I think that’s OK, too.”

She said she would like to leave something to her partner’s nieces and nephews, as well as animal shelters and domestic-violence shelters. Her best friend is a beneficiary.

Choosing an estate executor and who would handle money and health decisions on your behalf can be difficult when you don’t have children, financial advisers say. Using a promised inheritance as a reward for taking care of you when you are older isn’t a good solution, said Jay Zigmont , an investment adviser focused on childless people.

“Unfortunately, it is relatively common to see family members who are in the will decide to opt for cheaper medical care (or similar decisions) in order to protect what they will be inheriting,” he said in an email.

Kirsten Tompkins, who is from Birmingham, U.K., and works in consulting, along with her husband divided their estate among their dozen nieces and nephews.

Choosing heirs was the easy part. What is hard is figuring out whom to ask for help as she and her husband get older, she said.

“A lot of us are at an age where we are playing that role for our parents,” the 50-year-old said, referring to tasks such as providing tech support and taking parents to medical appointments. “Who is going to do that for us?”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

GAC unveils Australian specifications for its all-electric AION V SUV, combining global design and next-gen battery technology.

The wait is over. GAC has confirmed the Australian specifications for its all-electric medium SUV, the AION V, available in Premium and Luxury trims.

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.

In the remote waters of Indonesia’s Anambas Islands, Bawah Reserve is redefining what it means to blend barefoot luxury with environmental stewardship.