China’s Housing Market Woes Deepen Despite Stimulus

Home prices declined at a faster pace in May in major cities, while other data show a mixed picture for the world’s second-largest economy

China’s broken housing market isn’t responding to some of the country’s boldest stimulus measures to date—at least not yet.

The Chinese government has been stepping up support for housing and other industries in recent months as it tries to revitalise an economy that has continued to disappoint since the early days of the pandemic.

But fresh data for May showed that businesses and consumers remain cautious. Home prices continue to fall at an accelerating rate, and fixed-asset investment and industrial production, while growing, lost some momentum.

“China’s May economic data suggest that policymakers have a lot to do to sustain the fragile recovery,” Yao Wei, chief China economist at Société Générale, wrote in a client note on Monday.

The worst pain is in the property sector, which has been struggling to deal with oversupply and weak buyer sentiment since 2021, when a multiyear housing boom ended . The market still doesn’t appear to have found a floor, even after Beijing rolled out its most aggressive stimulus measures so far in mid-May in hopes of restoring confidence.

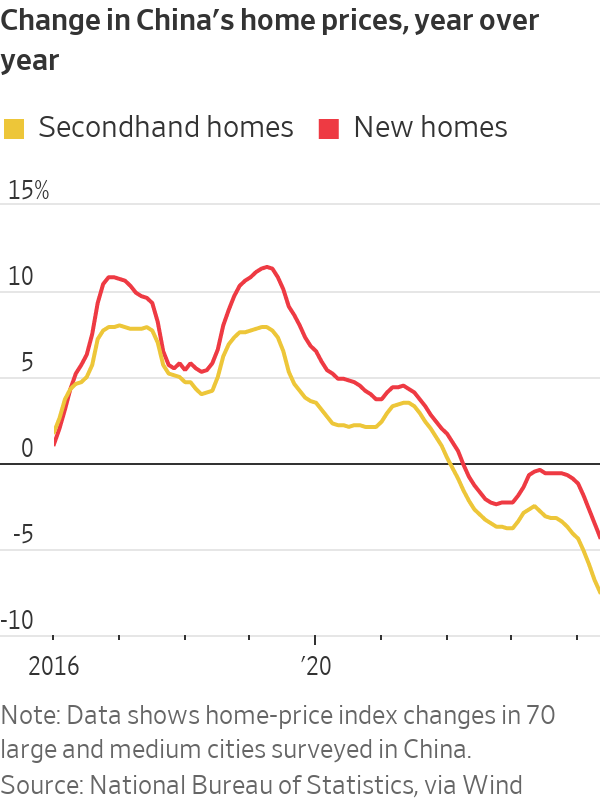

In major cities, new-home prices fell 4.3% in May compared with a year earlier, worse than a 3.5% decline in April, according to data released Monday by China’s National Bureau of Statistics. Prices in China’s secondhand home market tumbled 7.5%, compared with a 6.8% drop in April.

Home sales by value tumbled 30.5% in the first five months of this year compared with the same months last year.

“This data was certainly on the disappointing side and may ring some alarm bells, as May’s policy support package has not yet translated to a slower decline of housing prices, let alone a stabilisation,” said Lynn Song, chief China economist at ING.

Economists had also been hoping to see a wider recovery this month after Beijing started rolling out a planned issuance of 1 trillion yuan, the equivalent of $138 billion, in ultra-long sovereign bonds in May. The funds are designed to help pay for infrastructure and property projects backed by the authorities. Investors gobbled up the first batch of these bonds.

Monday’s bundle of economic data, however, underlined how the country still isn’t firing on all cylinders.

Retail sales, a key metric of consumer spending, rose 3.7% in May from a year earlier, compared with 2.3% in April, according to the National Bureau of Statistics. While the trend is heading in the right direction, it is still a relatively subdued level of growth, and below what most economists believe is needed to kick-start a major revival in consumer spending.

The expansion in industrial production—5.6% in May compared with a year earlier—was down from April’s 6.7% increase. Fixed-asset investment growth, of which 40% came from property and infrastructure sectors, also decelerated, to 3.5% year-over-year growth in May from 3.6% in April.

Key to the sluggish economic activity data in May—and China’s outlook going forward—is the crisis in the property market, which has proven hard for policymakers to address.

The property rescue package in May included letting local governments buy up unsold homes, removing minimum interest rates on mortgages, and reducing payments for potential home buyers. It also included as its centrepiece a $41 billion so-called re-lending program launched by the People’s Bank of China, which would provide funding to Chinese banks to support home purchases by state-owned firms.

The hope was that by stepping in as a buyer of last resort for millions of properties, the government would manage to mop up unsold housing inventory and persuade wary home buyers to re-enter the market. In turn, Chinese consumers, who have most of their wealth tied up in real estate, would feel more confident about spending again, thereby lifting the overall economy.

But the size of the re-lending program wasn’t big enough to convince home buyers, said Larry Hu , chief China economist at Macquarie Group. “Meanwhile, their income outlook also stays weak given the current economic condition,” he said.

For the property market to bottom out and reach a new equilibrium, mortgage rates, which stand at around 3-4% in China, need to be as low as rental yields, which are currently below 2% in major cities, said Zhaopeng Xing, a senior China strategist at ANZ. He said that a large mortgage rate cut will need to happen eventually.

The other key part of China’s push to revive growth revolves around the manufacturing sector, with leaders funnelling more investment into factories to boost output and reduce the country’s reliance on foreign suppliers of key technologies.

The result has been a surge in production. But with domestic consumption not strong enough to absorb all those goods, many factories have been forced to cut prices and seek out more overseas buyers.

Data released earlier this month showed that Chinese exports rose faster in May than the month before.

However, the export push is butting into resistance as governments around the world worry about the impact of cheap Chinese competition on domestic jobs and industries. The European Union last week said it would impose new import tariffs on Chinese electric vehicles, describing China’s auto industry as heavily subsidised by the government, to the point where other countries’ automakers can’t fairly compete.

The U.S. has also hit Chinese cars and some other products with hefty duties, while countries including Brazil, India and Turkey have opened antidumping investigations into Chinese steel, chemicals and other goods.

Beijing says such moves are protectionist and that its industries compete fairly with global rivals.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Chinese carmaker GAC will expand its Australian electric vehicle line-up with the city-focused AION UT hatchback.

Strong rental fundamentals and tight supply have driven more than $155 million in Sydney apartment block and residential investment sales over the past year.

Sydney’s residential investment market has recorded $155 million in apartment block and townhouse sales over 2025, underscoring continued investor confidence in rental-led assets despite broader economic uncertainty.

The transactions were completed by Knight Frank’s Investment Sales agents James Masselos and Adam Droubi, who negotiated 19 sales across Sydney during the year.

Residential investments accounted for 75 per cent of their total sales activity, supported by more than 4,200 active purchaser enquiries.

Co-living deal sets national benchmark

Among the standout transactions was the off-market sale of 142 Carillon Avenue in Newtown, a 37-studio co-living apartment block located close to the University of Sydney and Royal Prince Alfred Hospital.

The property sold for $21.5 million, setting a new benchmark for the living sectors market nationally.

The deal achieved approximately $581,000 per bedroom, believed to be one of the highest per-bedroom results recorded for a co-living asset in Australia.

Inner-city assets trade in one line

Other notable sales included a group of 12 townhouses at 108 Illawarra Road in Marrickville, sold in one line for $14 million, and a block of 20 studio apartments at 171 Rowntree Street in Birchgrove, which changed hands for $6.7 million.

Both transactions reflected strong buyer competition for well-located residential assets with established income streams.

Supply constraints underpin momentum

Mr Masselos said Sydney’s apartment block market continued to benefit from tight supply and strong rental conditions.

“Apartment blocks and broader residential investments remain a robust asset class, underpinned by strong rental growth, record low vacancy levels and scarcity of stock,” he said.

He added that more than $25 million worth of residential investment opportunities are expected to come to market in 2026, with buyer enquiry remaining elevated.

Mr Droubi said competitive sales campaigns had become a feature of the market as investors sought secure income and long-term value.

“Supply constraints and ongoing population growth underpin market strength,” he said. “New approvals and completions lag demand, keeping stock tight and boosting both rents and prices.”

Vacancy rates keep pressure on rents

According to Knight Frank, rental demand across Sydney remains intense, with vacancy rates well below typical “healthy” levels.

Many middle and outer-ring suburbs are recording vacancies of around 1.5 per cent or lower, maintaining upward pressure on rents and reinforcing the appeal of residential investment assets.

Chinese carmaker GAC will expand its Australian electric vehicle line-up with the city-focused AION UT hatchback.

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?