Manila’s Bel-Air Neighbourhood Is as Posh as It Sounds

The enclave, close to the “Wall Street of the Philippines” and top schools, is among the affluent pockets benefitting from a surge in the capital’s luxury home prices

Makati, a major business district in the Philippines, has roots dating to the 17th century, but it wasn’t until the mid-1900s that the city began its rapid development.

Within that urban hub, the planned community of Bel-Air, once suburban housing requested by Philippine Airlines pilots (hence “Air” in the name) has matured into one of the most upmarket communities in Metro Manila. It’s now among the affluent pockets benefitting from a high-end housing boom in the Philippine capital, which led the world in luxury price growth last year, according to the latest Prime Global Cities Index from London-based property firm Knight Frank.

Manila’s luxury home prices remained the fastest rising in the world in the first quarter of this year as well.

“This increase is driven by rising housing demand, with agents reporting a surge in requirements from expatriates returning to manage local businesses as the economy shows strong performance,” Knight Frank wrote in the report.

The name Bel-Air refers to both the barangay—an administrative division of a larger city—and to Bel-Air Village, one of several exclusive gated housing communities developed in Makati. Bel-Air Village was developed in four phases during the 1950s and 1960s, identified by number.

With just over 36,000 residents according to the 2020 Philippine census, Barangay Bel-Air has the second-largest population of Makati’s 33 barangays. Makati, with a population of nearly 630,0000, is now a major Asian economic centre, home to leading local and multinational enterprises and known colloquially as the Wall Street of the Philippines.

Boundaries

The level, tree-lined streets of Bel-Air cover 171.2 hectares (more than 420 acres) in central Makati, southeast of Manila.

Barangay Bel-Air’s borders unevenly resemble a tobacco pipe and the borders touch several others. Poblacion and Guadalupe Viejo bound it to the north, Urandeta, San Lorenzo and Forbes Park to the south, Guadalupe Viejo and Pinagkaisahan to the east and Santa Cruz and San Antonio to the west.

While Bel-Air Village is only made up of residences, the wider barangay encompasses mixed-use areas like Salcedo Village. Barangay Bel-Air also includes the Ayala North office development, Ayala Triangle Gardens and the Buendia Avenue Extension.

Price

A survey of online real estate listings by financial company Digido indicated buyers can expect to spend between 135 million to 424 million pesos (US$2.35 million to US$7.39 million) when purchasing in Barangay Bel-Air.

At the price spectrum’s lower end, luxury buyers can purchase condos or Bel-Air Village homes with smaller living spaces or fewer amenities and updates.

A Knight Frank listing for a four-bedroom, two-bathroom, two-story home in Bel-Air 1, with a pool and parking for two cars costs 220 million pesos. Meanwhile, a five-bedroom, tri-level penthouse in Barangay Bel-Air’s Avignon Tower is selling for 230 million pesos.

A review of listings from the DotProperty multiple listing service show updated and newer build four- or five-bedroom homes in Bel Air Village priced between 350 million and 400 million pesos. A Luxe Realty listing for a two-story Bel-Air 4 house with a 698-square-meter lot is at the market’s higher end, 400 million pesos. It has four bedrooms, three baths, a swimming pool, gazebo, rooms for domestic staff and a three-car garage.

Housing Stock

Bel-Air Village has 950 lots and 32 streets, on which three- to five-bedroom homes are common. Homes frequently feature amenities like swimming pools, outdoor living spaces like lanais and multi-car garages. Original Bel-Air homes date from the 1950s and ’60s and borrow architectural cues taken from mid-century American suburban developments. Light-filled, recently constructed luxury homes are also available to buyers at a premium.

Luxury condominium options within Barangay Bel-Air include the 46-story, four-tower Jazz Residences and the 36-story Regency at Salcedo.

Amenities

Bel-Air residents live near some of the best high-end shopping in the Philippines. This includes the upmarket Glorietta and Greenbelt malls. The new One Ayala mixed-use development, which includes offices, retail, a four-star hotel and a public transport hub, is expected to fully open this year.

Bel-Air is located a short drive from the Manila Polo Club and the members-only Manila Golf and Country Club in neighbouring Forbes Park, the latter of which offers skyline views from the greens.

Bel-Air families are spoiled for choice regarding school options. Several faith-based and international schools are within the city of Makati. Bel-Air is also a 15-minute drive from two of Metro Manila’s most prestigious schools, both in Bonifacio Global City. International School Manila offers middle and high school education, while the British School Manila educates students from nursery school through high school graduation.

What Makes It Unique

Properties in the gated Bel-Air Village offer residents privacy, security and access to exclusive facilities like badminton and basketball courts, function rooms and a gym. Though metro Manila is known for having few green spaces, Bel-Air 2 and 3 have parks.

Bel-Air residents are within walking distance to Makati’s Ayala Triangle Gardens, a leafy two-hectare urban park. Residents can also shop for fresh food and other wares at the 100-plus vendor Salcedo Community Market, open every Saturday at Jamie C. Velasquez Park in Salcedo Village.

Who Lives There

Bel-Air households skew older and smaller than other parts of Metro Manila, but the barangay’s central location, cleanliness and security make it attractive to families with school-age children. Convenient access to Makati’s central business district makes Bel-Air appealing to executives who work there. Makati is also home to several embassies, with Bel-Air housing the Consulates General of Ireland and San Marino.

Notable Residents

Former Manila mayor Lito Atienza and his son, television host and former Manila city councilor Kim “Kuya Kim” Atienza, are among the residents who have lived in the barangay over the years. Actors Dominic Ochoa, Dingdong Dantes and Marian Rivera have also called Bel-Air home over the years

Outlook

Manila experienced a 26.2% year-over-year increase in the price of luxury homes in the first quarter, according to Knight Frank, the highest of the 45 major cities around the world ranked in its index released Friday.

Colliers International expects the ultra-luxury segment of Philippine real estate to remain resilient “amid the rising interest and mortgage rates.” The firm reported Makati central business district has seen improved rates of condominiums leased in 2023.

“Leasing demand continues to be driven by returning expatriates looking for bigger units that are also near offices and international schools,” the Colliers report said.

With luxury developments proliferating in other areas of Metro Manila, these factors may suggest future scarcity and price growth in elite barangays like Bel-Air.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

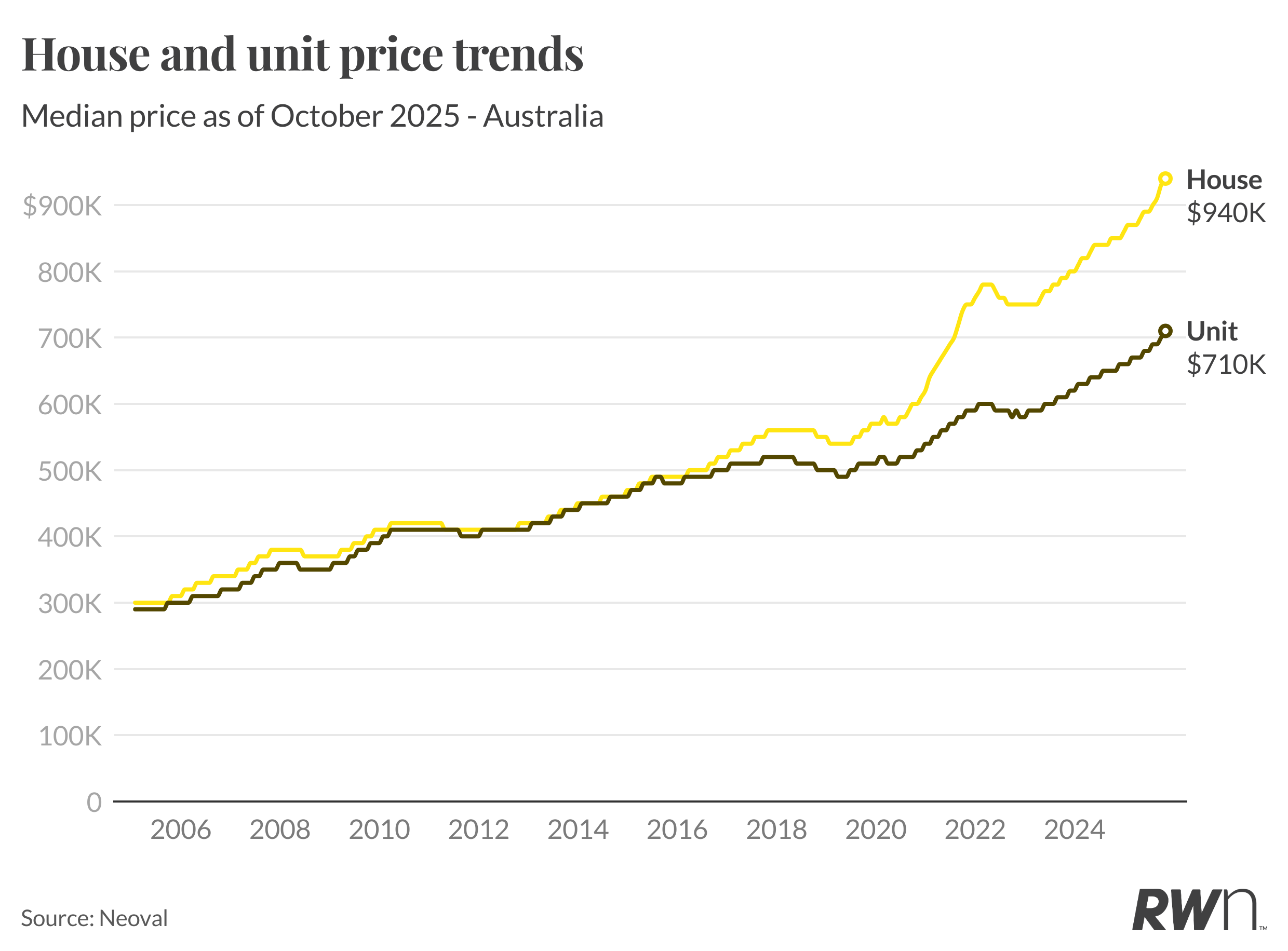

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Australian house prices are surging again, delivering double-digit annual growth months ahead of schedule.

Nationally, the median house price climbed 1.1 per cent in October to $940,000, lifting annual growth to 10.6 per cent, the first double-digit increase since the 2021–22 property boom.

Market Resilience Surprises Analysts

The acceleration comes earlier than expected, according to Ray White Group Chief Economist Nerida Conisbee, who says the milestone was originally forecast for the end of the year.

“Stronger-than-expected October gains and continued tight supply across most markets have pushed growth ahead of schedule,” Conisbee said. “This shows how resilient demand has remained through spring.”

Perth (+14.8 per cent), Brisbane (+12.5 per cent) and Adelaide (+10.8 per cent) continue to lead the charge among capital cities, while Sydney (+8.6 per cent) and Melbourne (+6.5 per cent) show steady, consistent increases.

Regional Markets Extend Their Lead

Beyond the capitals, regional Australia is powering ahead, particularly in the resource states.

Regional Western Australia jumped 16.4 per cent year-on-year, and regional Queensland followed close behind at 14.5 per cent, as population growth and affordability continue to drive demand.

Units Outperform Houses

Unit prices rose even more sharply in October, up 1.4 per cent to $710,000, marking 9.2 per cent annual growth. Conisbee said affordability pressures, new first home buyer incentives, and a lack of available stock are pushing more buyers into the apartment market.

“Units are now seeing stronger monthly gains than houses, reflecting both affordability constraints and renewed first-home-buyer activity,” she said.

The biggest monthly jumps were in Perth (+1.6 per cent), Adelaide (+1.5 per cent), and Brisbane (+1.4 per cent). Melbourne’s unit market also firmed, up 1.6 per cent, as buyers returned to lower price brackets.

Spring Demand Defies Higher Listings

Despite an influx of spring listings, new stock has failed to match the intensity of buyer demand. Nationally, house prices have now risen every month since February, and unit prices every month since March.

“The pace of growth shows demand hasn’t been dampened by higher supply,” Conisbee said.

Outlook: Steady Growth Into 2026

The data comes as the Reserve Bank prepares for its Melbourne Cup Day meeting, where rates are expected to remain on hold at 3.6 per cent.

With inflation easing only gradually and unemployment sitting around 4.5 per cent, analysts expect monetary policy to stay steady for now.

Ray White’s forecast suggests 2025 will close with high single- to low double-digit annual growth nationally, with smaller capitals and regional areas tipped to outperform well into 2026.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?