America’s Empty Apartments Are Finally Starting to Fill Up

If that demand is sustained, landlords likely will have more pricing power starting sometime next year

The biggest apartment construction boom in four decades flooded the market with new supply over the past two years. Apartment owners had to contend with a surge in empty units.

That is starting to change.

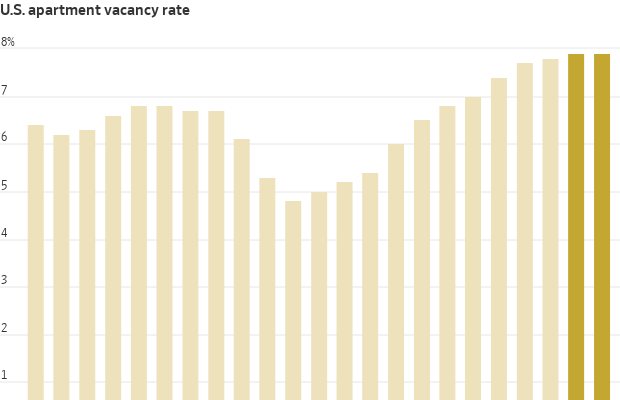

The vacancy rate, or the share of apartment units that are empty, stopped rising for the first time in three years last quarter, as demand for apartments rose to its highest levels since 2021, according to CoStar .

The more than 1.2 million new apartment units that were built during the past two years are filling up. If that demand is sustained, if the economy remains strong and if housing prices remain near record highs, landlords likely will have more pricing power starting sometime next year. That could allow building owners to raise rents more than they have recently.

Some 672,000 new apartment units will have been completed by the end of this year, but only about half that number is expected in 2025, and even fewer in 2026, CoStar said.

“The worst of the pressures on pricing from new supply are likely behind us,” said Eric Bolton , chief executive of publicly traded landlord Mid-America Apartment Communities , on an October earnings call.

Housing affordability has become a hot-button election issue at the federal and local levels. Any sign that rents are poised to rise in 2025 could intensify pressure on the new administration to address housing costs. President Biden announced a plan over the summer to cap rent increases, though it would need to pass Congress.

Nationally, sales of apartment buildings have also started to pick up again, as investors become more confident that the market is bottoming and sellers are more willing to acquiesce on price.

Renters were hit hard by the historically high rent increases during the pandemic years, especially in Sunbelt cities, such as Phoenix and Tampa, Fla., where rents rose 20% or more during 12-month periods.

Rents for new leases nationwide have held close to flat for more than a year. That is due in part to a big split between supply-heavy Sunbelt cities, some of which have seen rent cuts, and the rest of the country, which hasn’t.

Renters who choose to renew their leases were still paying a 3.5% rent increase on average as of this past August, the most recent month data was available from Yardi Matrix.

Throughout this year, the places with the highest renewal rent growth have been on the coasts and in the Midwest. New York City, Los Angeles, Indianapolis and Columbus, Ohio, saw renewal rent increases of 5% or more in July, according to Yardi.

Increased return to office orders in major employment hubs may also start translating into even more urban rental demand soon, especially in coastal cities.

In Seattle, Equity Residential said in an October earnings call that it is seeing a pickup in leasing from Amazon employees, who are locking in apartments ahead of a five-day office attendance policy, scheduled to begin in January.

On the flip side is Austin, Texas, which has experienced a building boom after companies such as Tesla and Oracle moved offices there. Austin’s vacancy rate, if new buildings are included, is the highest in the country at over 15%, according to CoStar.

Rent growth for new leases in the Texas capital ranks last among major metros during the past year. Landlords of new luxury buildings are still offering big concessions, such as months of free rent, to fill up units. undefined undefined “Basically, the worst apartment market in the country right now is Austin,” said Matt Rosenthal , managing partner of multifamily investor Eastham Capital.

On an annual basis, apartment building sales have grown for two consecutive quarters, according to MSCI Real Assets. Places seeing some of the biggest increases in sales include Denver, San Francisco and the Washington, D.C. suburbs.

Apartment companies also continue to feel tailwinds from renters locked out of homeownership. Major owners have remarked on how few of their renters move out to purchase homes now, amid some of the worst conditions for home-purchase affordability in four decades. That is unlikely to change much in 2025.

“Probably the biggest story this year that we’ve seen [is] from people coming in the front door and then not leaving [out] the back door,” said Joe Fisher , president of publicly traded apartment owner UDR .

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

Buyer demand, seller confidence and the First Home Guarantee Scheme are setting up a frantic spring, with activity likely to run through Christmas.

The spring property market is shaping up as the most active in recent memory, according to property experts Two Red Shoes.

Mortgage brokers Rebecca Jarrett-Dalton and Brett Sutton point to a potent mix of pent-up buyer demand, robust seller confidence and the First Home Guarantee Scheme as catalysts for a sustained run.

“We’re seeing an unprecedented level of activity, with high auction numbers already a clear indicator of the market’s trajectory,” said Sutton. “Last week, Sydney saw its second-highest number of auctions for the year. This kind of volume, even before the new First Home Guarantee Scheme (FHGS) changes take effect, signals a powerful market run.”

Rebecca Jarrett-Dalton added a note of caution. “While inquiries are at an all-time high, the big question is whether we will have enough stock to meet this demand. The market is incredibly hot, and this could lead to a highly competitive environment for buyers, with many homes selling for hundreds of thousands above their reserve.”

“With listings not keeping pace with buyer demand, buyers are needing to compromise faster and bid harder.”

Two Red Shoes identifies several spring trends. The First Home Guarantee Scheme is expected to unlock a wave of first-time buyers by enabling eligible purchasers to enter with deposits as low as 5 per cent. The firm notes this supports entry and reduces rent leakage, but it is a demand-side fix that risks pushing prices higher around the relevant caps.

Buyer behaviour is shifting toward flexibility. With competition intense, purchasers are prioritising what they can afford over ideal suburb or land size. Two Red Shoes expects the common first-home target price to rise to between $1 and $1.2 million over the next six months.

Affordable corridors are drawing attention. The team highlights Hawkesbury, Claremont Meadows and growth areas such as Austral, with Glenbrook in the Lower Blue Mountains posting standout results. Preliminary Sydney auction clearance rates are holding above 70 per cent despite increased listings, underscoring the depth of demand.

The heat is not without friction. Reports of gazumping have risen, including instances where contract statements were withheld while agents continued to receive offers, reflecting the pressure on buyers in fast-moving campaigns.

Rates are steady, yet some banks are quietly trimming variable and fixed products. Many borrowers are maintaining higher repayments to accelerate principal reduction. “We’re also seeing a strong trend in rent-vesting, where owner-occupiers are investing in a property with the eventual goal of moving into it,” said Jarrett-Dalton.

“This is a smart strategy for safeguarding one’s future in this competitive market, where all signs point to an exceptionally busy and action-packed season.”

Two Red Shoes expects momentum to carry through the holiday period and into the new year, with competition remaining elevated while stock lags demand.

Micro-needling promises glow and firmness, but timing can make all the difference.

On October 2, acclaimed chef Dan Arnold will host an exclusive evening, unveiling a Michelin-inspired menu in a rare masterclass of food, storytelling and flavour.