Eight Smart Home Must-Haves

These are the smartest bits of tech for your home.

Smart domestic features increasingly inform luxury living. And where once this didn’t move past a robotic vacuum or some sensor lights, the ultimate modern home should be stacked with technology that ultimately makes for an elevated daily experience.

Here, eight absolute must-haves.

Savant Pro

Allows for the control of all smart home gadgetry under one system – think lighting, sound, TV, climate control, blinds and more. Video tiling and the TrueControl app allow you to add up to 9 things to a single screen – including from various streaming services – giving you complete control over your entertainment, while. the system also allows you to program ‘scenes’ to be set, which can lock doors, turn off light and engage security cameras from the touch of an Apple watch.

POA; savant.com

Offmat Tulèr Responsive Kitchen

The world’s first responsive kitchen bench, Tulèr weighs, cooks and washes through gesture controls and touch surfaces enabled by a system of state-of-the-art sensors. You’ll feel like a domestic sorcerer as you magically wave at the workspace to open drawers, commence induction cooking, make the kitchen sink appear and disappear and activate built-in countertop scales – which displays weight via a built in light or chosen device.

POA; tipic.it

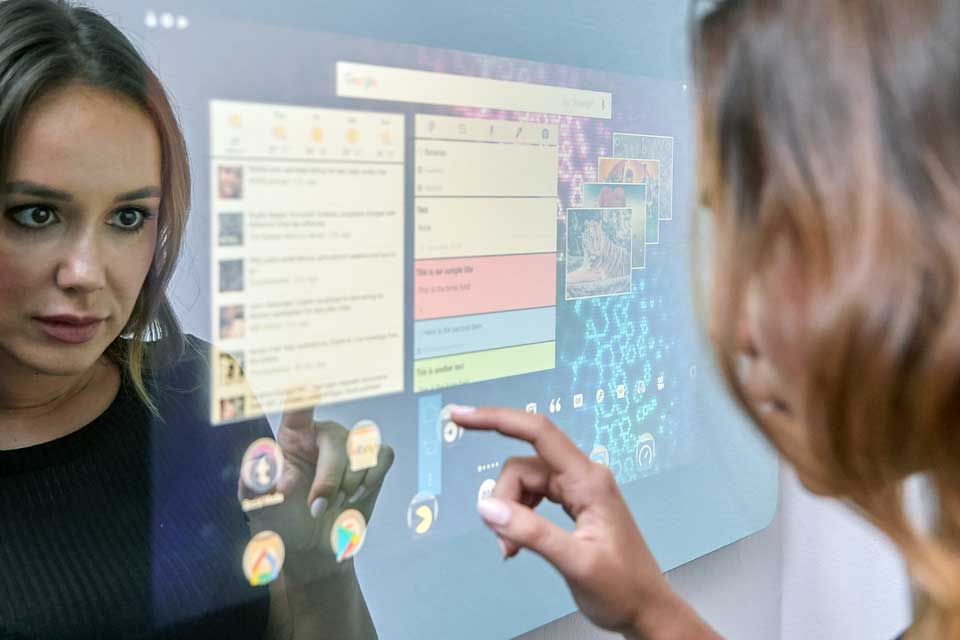

Embrace Smart Mirror

Believe it or not, ‘splash-proof’ isn’t even the main selling point here, this so-called ‘smart mirror’ making for easy living with in-built voice command, gesture and touch screen capabilities. This allows a user to work with Google assistant, send emails, skype or video chat with friends, control the lights or play music while getting ready. Or, watch shaving tutorials and more through the 23-inch touchscreen display.

Approx. $1390; embracesmartmirror.com

Ecobee Smart Thermostat With Voice Control

Once connected to an air-conditioner, this thermostat learns and adapts to an occupant’s schedule to deliver comfortable temperatures at all times. Make adjustments via voice control, set timers and schedules and also regulate humidity (if connected to a humidifier).

Approx. $346; ecobee.com

LG’s CX OLED TV

Arguably the smartest TV in market, LG’s CX OLED leads the pack with its webOS technology. The user interface is built around launch bar for apps, inputs and features – which like a computer is customisable. You can Miracast images from your smartphone, screen share and use voice commands through LG’s own AI platform, or trust favourites like Amazon Alexa and Google Assistant. To help keep the image crisp, Dolby Vision IQ automatically adjusts the picture depending on the ambient light in the room.

$4295; lg.com

Vivint Home Security & Bit Defender Box

Vivint has built a reputation as the go-to for smart home security. With a range of customisable packages, Vivint offers smart sensors (for doors and windows), smart locks (to control remotely), doorbell cameras, outdoor cameras and more all controllable via a single app. You can set the outdoor cameras to record someone’s approach and view them via your smartphone. Physical threats aside, hackers are increasingly breaching smart home technologies. Enter the BitBox Defender, which monitors every device connected to a residence’s network and alerts to any threats by smartphone.

POA; Vivint.com / $149; bitdefender.com

Wi-Charge R1 Wireless Charger

More gadgetry means a greater need to charge. Here, Wi-Charge and its R1 ultra-compact chargers create wireless charging from any power or light socket. With accuracy of 9 metres, it projects infrared beams across the room charging a given device without a second thought.

Coming soon; wi-charge.com

U by Moen Smart Faucet

This, tap, as we would say, offers temperature-controlled water accessible through Google Assistant and Amazon Alexa. It remembers favourite temperatures and reacts to conversational requests like ‘a little warmer’. Beyond temperature control, the U by Moen can also disperse water in specific quantities, handy for when cooking and you need exactly 150ml. Offered in a wide variety of styles to cover most kitchen designs.

Approx. $620; moen.com

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

This may be contributing to continually rising weekly rents

There has been a substantial increase in the number of Australians earning high incomes who are renting their homes instead of owning them, and this may be another element contributing to higher market demand and continually rising rents, according to new research.

The portion of households with an annual income of $140,000 per year (in 2021 dollars), went from 8 percent of the private rental market in 1996 to 24 percent in 2021, according to research by the Australian Housing and Urban Research Institute (AHURI). The AHURI study highlights that longer-term declines in the rate of home ownership in Australia are likely the cause of this trend.

The biggest challenge this creates is the flow-on effect on lower-income households because they may face stronger competition for a limited supply of rental stock, and they also have less capacity to cope with rising rents that look likely to keep going up due to the entrenched undersupply.

The 2024 ANZ CoreLogic Housing Affordability Report notes that weekly rents have been rising strongly since the pandemic and are currently re-accelerating. “Nationally, annual rent growth has lifted from a recent low of 8.1 percent year-on-year in October 2023, to 8.6 percent year-on-year in March 2024,” according to the report. “The re-acceleration was particularly evident in house rents, where annual growth bottomed out at 6.8 percent in the year to September, and rose to 8.4 percent in the year to March 2024.”

Rents are also rising in markets that have experienced recent declines. “In Hobart, rent values saw a downturn of -6 percent between March and October 2023. Since bottoming out in October, rents have now moved 5 percent higher to the end of March, and are just 1 percent off the record highs in March 2023. The Canberra rental market was the only other capital city to see a decline in rents in recent years, where rent values fell -3.8 percent between June 2022 and September 2023. Since then, Canberra rents have risen 3.5 percent, and are 1 percent from the record high.”

The Productivity Commission’s review of the National Housing and Homelessness Agreement points out that high-income earners also have more capacity to relocate to cheaper markets when rents rise, which creates more competition for lower-income households competing for homes in those same areas.

ANZ CoreLogic notes that rents in lower-cost markets have risen the most in recent years, so much so that the portion of earnings that lower-income households have to dedicate to rent has reached a record high 54.3 percent. For middle-income households, it’s 32.2 percent and for high-income households, it’s just 22.9 percent. ‘Housing stress’ has long been defined as requiring more than 30 percent of income to put a roof over your head.

While some high-income households may aspire to own their own homes, rising property values have made that a difficult and long process given the years it takes to save a deposit. ANZ CoreLogic data shows it now takes a median 10.1 years in the capital cities and 9.9 years in regional areas to save a 20 percent deposit to buy a property.

It also takes 48.3 percent of income in the cities and 47.1 percent in the regions to cover mortgage repayments at today’s home loan interest rates, which is far greater than the portion of income required to service rents at a median 30.4 percent in cities and 33.3 percent in the regions.

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts