EVs Made Up 10% of All New Cars Sold Last Year

China, Europe drive electric-vehicle expansion as U.S. gains traction

BERLIN—Electric-vehicle sales crossed a key milestone last year, achieving around 10% market share for the first time, driven mainly by strong growth in China and Europe, according to fresh data and estimates.

While EVs still make up a fraction of car sales in the U.S., their share of the total market is becoming substantial in Europe and China, and they are increasingly influencing the fortunes of the car market there as the technology goes mainstream. The surge in EV sales also contrasted with the broader car market that suffered from economic worries, inflation and production disruptions.

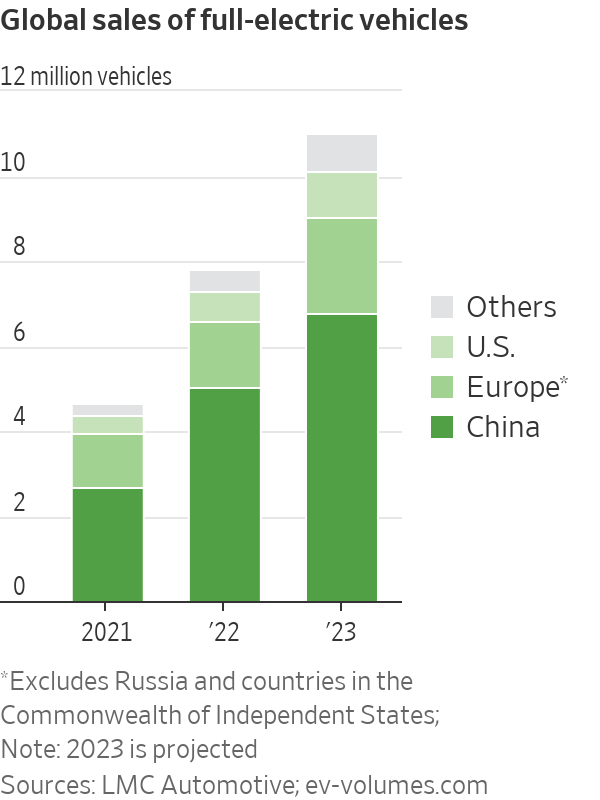

Global sales of fully electric vehicles totalled around 7.8 million units, an increase of as much as 68% from the previous year, according to preliminary research from LMC Automotive and EV-Volumes.com, research groups that track automotive sales.

Ralf Brandstätter, the head of Volkswagen AG’s China business, told reporters on Friday that electric vehicles would continue expanding fast and that China could soon reach a point where sales of conventional vehicles begin to permanently decline as plug-in vehicles take bigger market share.

“Last year, every fourth vehicle we sold in China was a plug-in, and this year it will be every third auto,” Mr. Brandstätter said. “We haven’t reached the tipping point yet, but we’re expecting to get there between 2025 and 2030.”

For the full year, fully electric vehicles accounted for 11% of total car sales in Europe and 19% in China, according to LMC Automotive. Combined with plug-in hybrid vehicles, which can be plugged in to recharge the battery but also have a small combustion engine, the share of electric vehicles sold in Europe rose to 20.3% of the total last year, according to EV-Volumes.com.

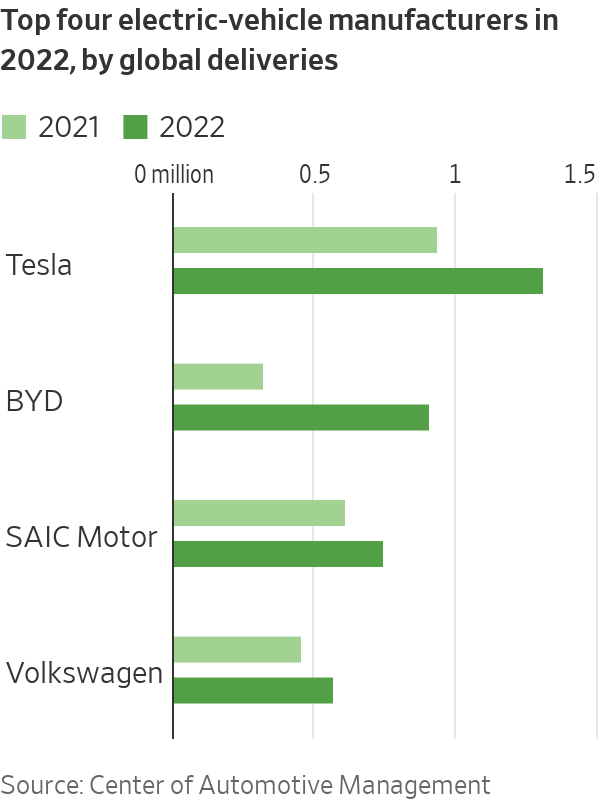

The U.S. lags behind China and Europe in the rollout of EVs, but last year auto makers sold 807,180 fully electric vehicles in the U.S., a rise in the share of all-electric vehicles to 5.8% of all vehicles sold from 3.2% the year before. Tesla is still the world’s dominant EV maker, but conventional auto makers are shortening its lead with new electric-model launches.

In Germany, the largest auto market in Europe, electric vehicles accounted for 25% of new vehicle production last year, according to VDA, the German automotive manufacturers association. In December, there were more EVs sold in the country than conventional cars.

New-car sales overall fell around 1% to 80.6 million vehicles, according to the LMC data, with nearly 4% growth in China helping to offset a decline of 8% in the U.S. and 7% in Europe, which was hit by the weakening global economy, soaring energy costs, supply-chain disruptions and the war in Ukraine.

Bayerische Motoren Werke AG, the German luxury-car maker, was one of many manufacturers last year to see sales of plug-in models rise even as overall sales tumbled. BMW reported a 5% decline in total new-car sales but saw EV sales more than double last year.

“We are confident that we can repeat this success next year, because we have a continued high order backlog for fully electric models,” BMW sales chief Pieter Nota, said this month, commenting on the growth in sales of electric models.

VW, Europe’s biggest manufacturer by sales, said on Thursday that overall new-car sales fell 7% to 8.3 million vehicles last year, but sales of electric vehicles rose 26% to 572,100 units. The sales figures encompass the company’s large stable of brands, including VW, sports-car maker Porsche, luxury-car brand Audi and passenger-car brands Skoda and Seat.

The bulk of VW’s sales of EVs were in Europe, but sales growth was strongest in China and the U.S., the company said.

Other manufacturers reported a similar divide of strong growth in sales of electric cars—boosted in part by the availability of a wider array of models in addition to market leader Tesla Inc.—and weak or declining sales of conventional vehicles. Ford Motor Co., Mercedes-Benz Group AG and BMW each said their EV sales more than doubled in 2022, while their total vehicle sales declined.

Photos: The EV Rivals Aiming for Tesla’s Crown in China

European auto makers have focused their EV production and sales on home markets as they try to meet European Union emissions regulations. They also began last year to more aggressively expand their EV business in other major markets, especially China and the U.S.

In China, which accounted for around two-thirds of global sales of fully electric cars last year, domestic manufacturers are gaining ground on traditional Western auto makers and are also beginning to expand into Europe and the U.S.

Worldwide, Tesla maintained the top spot in a global ranking of manufacturers by sales of all-electric vehicles, followed by Chinese manufacturers BYD Co. and SAIC Motor Corp., and brands belonging to the VW group, according to a study published by Stefan Bratzel, director of the Center of Automotive Management, an automotive-research group in Germany.

In the U.S., Ford is the second-largest maker of EVs by sales, followed by Hyundai Motor Co. and its affiliate Kia Corp. Meanwhile, General Motors Co., VW and Nissan Motor Co. lost EV market share in the U.S. last year.

While EVs are showing signs of becoming more mainstream globally, analysts warn that repeating last year’s strong EV performance in 2023 could be difficult as economic worries weigh on consumers, and cash rebates on EVs are reduced or scrapped completely in some countries. Rising electricity prices in Europe in the wake of Russia’s attack on Ukraine have also diminished the appeal of EVs compared with gas-powered cars.

Germany witnessed a surge in last-minute EV purchases in December, as consumers rushed to take advantage of government incentives before they were cut this year. Since Jan. 1, government subsidies for the purchase of an EV with a listing price of up to 40,000 euros, equivalent to about $43,000, fell to 4,500 euros from 6,000 euros previously.

For the past couple of years, auto makers, especially in Europe, have struggled to find key components such as computer chips to maintain production in pace with demand. This mismatch between demand and supply is one reason auto makers posted lofty profits last year despite broadly weaker sales.

As the economy weakens, supply-chain problems ease and subsidies dry up, manufacturers could find it harder to maintain the high prices for new cars as they chase potentially fewer buying customers. This could result in a downward price spiral that potentially hits profits.

“Demand is likely to weaken in the coming year,” said Peter Fuss, an auto analyst with Ernst & Young. “The weak economy will cause retail and business consumers to be more reluctant. And it is possible that supply will outpace demand and we will begin to see discounts again.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

From warmer neutrals to tactile finishes, Australian homes are moving away from stark minimalism and towards spaces that feel more human.

French luxury-goods giant’s results are a sign that shoppers weren’t splurging on its collections of high-end garments in the run-up to the holiday season.

From warmer neutrals to tactile finishes, Australian homes are moving away from stark minimalism and towards spaces that feel more human.

For years, Australian interiors have been ruled by restraint. Pale palettes, clean lines and an almost reverential devotion to minimalism dominated living rooms and bedrooms alike. In 2026, that aesthetic is finally softening.

Designers are responding to a cultural shift that favours comfort and emotional connection over perfection. Homes are becoming warmer, more layered and more expressive, reflecting a growing desire for spaces that feel restorative rather than simply impressive. The new look is not about excess, but about depth.

Colour plays a central role in this evolution. Cool whites and greys are giving way to warmer, earth-based tones such as sandstone, oatmeal and soft mushroom, often lifted with muted greens or gentle spice notes. The effect is grounding and quietly sophisticated, creating interiors that feel calm without tipping into blandness.

Texture matters just as much. Natural materials, tactile fabrics and layered finishes are being used to add softness and movement to rooms that once relied on sharp contrasts. Raw timbers, stone and linen sit alongside more refined details, striking a balance between polish and authenticity. This look feels considered without being clinical.

Diana Altiparmakova, Head of Product and Marketing for Luxaflex Window Fashions, recognises that this movement toward layered softness marks a distinct shift from 2025.

“Last year’s approach leaned into minimalism and simplicity, but 2026 expands into a more expressive and sensory direction as designers and homeowners are favouring depth, tactility and warmer tones to create environments that feel cocooning and emotionally supportive,” she said.

“No longer just a practical addition, window coverings are also helping shape this design evolution by enhancing comfort, mood and individuality within the home.

“Window coverings in 2026 aren’t just about blocking light or adding privacy, they’re about shaping atmosphere, improving comfort and supporting wellbeing.

“Often seen as the finishing touch to a home’s overall design, the right window coverings can elevate a room, creating depth and warmth, while providing functionality tailored to the homeowner’s individual needs.”

Light has become a defining feature of how homes are designed and lived in. Rather than flooding interiors indiscriminately, there is a growing emphasis on controlling and filtering natural light to suit different moments of the day. Window treatments are no longer treated as an afterthought but as part of a space’s architectural language, shaping mood as much as function.

Technology is quietly supporting this shift. Automation is being embraced not for novelty, but for ease. The ability to adjust light and privacy seamlessly throughout the day speaks to a broader desire for homes that work intuitively around daily life, rather than demanding attention.

In particular, across regional and coastal homes, softer interpretations of farmhouse and coastal styles are emerging. These interiors lean into relaxed elegance, using filtered daylight, natural textures and unfussy forms to create spaces that feel timeless rather than trend-led. Fabric-forward window dressings, in particular, are used to soften hard architectural elements and create a sense of ease.

What defines this new design direction is not a single look, but a mindset. In a world that feels increasingly loud and accelerated, the modern Australian home is being reshaped as a place of retreat. Beauty still matters, but so does comfort, warmth and emotional resonance.

Minimalism is not disappearing. It is simply growing up.

From Italy’s $93,000-a-night villas to a $20,000 Bowral château, a new global ranking showcases the priciest Airbnbs available in 2026.

A bold new era for Australian luxury: MAISON de SABRÉ launches The Palais, a flagship handbag eight years in the making.