DOUBLE-DIGIT HOUSE PRICE GROWTH ARRIVES AHEAD OF EXPECTATIONS

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

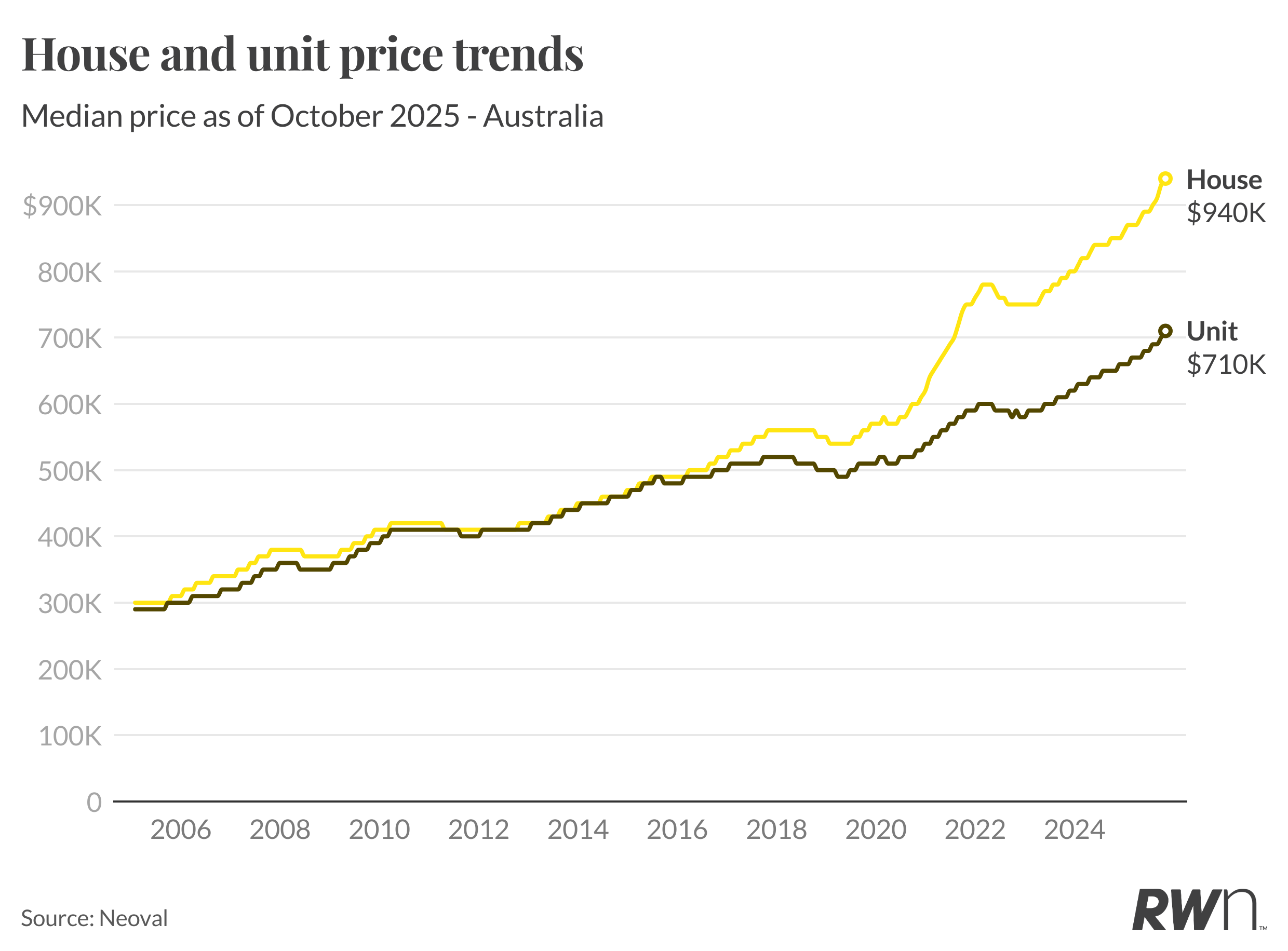

Australian house prices are surging again, delivering double-digit annual growth months ahead of schedule.

Nationally, the median house price climbed 1.1 per cent in October to $940,000, lifting annual growth to 10.6 per cent, the first double-digit increase since the 2021–22 property boom.

Market Resilience Surprises Analysts

The acceleration comes earlier than expected, according to Ray White Group Chief Economist Nerida Conisbee, who says the milestone was originally forecast for the end of the year.

“Stronger-than-expected October gains and continued tight supply across most markets have pushed growth ahead of schedule,” Conisbee said. “This shows how resilient demand has remained through spring.”

Perth (+14.8 per cent), Brisbane (+12.5 per cent) and Adelaide (+10.8 per cent) continue to lead the charge among capital cities, while Sydney (+8.6 per cent) and Melbourne (+6.5 per cent) show steady, consistent increases.

Regional Markets Extend Their Lead

Beyond the capitals, regional Australia is powering ahead, particularly in the resource states.

Regional Western Australia jumped 16.4 per cent year-on-year, and regional Queensland followed close behind at 14.5 per cent, as population growth and affordability continue to drive demand.

Units Outperform Houses

Unit prices rose even more sharply in October, up 1.4 per cent to $710,000, marking 9.2 per cent annual growth. Conisbee said affordability pressures, new first home buyer incentives, and a lack of available stock are pushing more buyers into the apartment market.

“Units are now seeing stronger monthly gains than houses, reflecting both affordability constraints and renewed first-home-buyer activity,” she said.

The biggest monthly jumps were in Perth (+1.6 per cent), Adelaide (+1.5 per cent), and Brisbane (+1.4 per cent). Melbourne’s unit market also firmed, up 1.6 per cent, as buyers returned to lower price brackets.

Spring Demand Defies Higher Listings

Despite an influx of spring listings, new stock has failed to match the intensity of buyer demand. Nationally, house prices have now risen every month since February, and unit prices every month since March.

“The pace of growth shows demand hasn’t been dampened by higher supply,” Conisbee said.

Outlook: Steady Growth Into 2026

The data comes as the Reserve Bank prepares for its Melbourne Cup Day meeting, where rates are expected to remain on hold at 3.6 per cent.

With inflation easing only gradually and unemployment sitting around 4.5 per cent, analysts expect monetary policy to stay steady for now.

Ray White’s forecast suggests 2025 will close with high single- to low double-digit annual growth nationally, with smaller capitals and regional areas tipped to outperform well into 2026.

From warmer neutrals to tactile finishes, Australian homes are moving away from stark minimalism and towards spaces that feel more human.

French luxury-goods giant’s results are a sign that shoppers weren’t splurging on its collections of high-end garments in the run-up to the holiday season.

Australia’s housing market is expected to keep rising in 2026, but new research shows growth will increasingly depend on postcode, not postcode averages.

Confidence across Australia’s housing market remains firm heading into 2026, but momentum is expected to diverge sharply by state as affordability ceilings, interest rate uncertainty and local supply constraints reshape conditions, according to new research from Cotality and a broad range of market forecasters.

Findings from Cotality’s Decoding 2026 report, based on responses from real estate agents and finance professionals nationwide, show 87% of respondents expect dwelling values to rise over the year ahead, while just 3.5% anticipate prices will fall.

Almost half forecast price growth of more than 5%, highlighting ongoing optimism following widespread gains through 2025.

That outlook broadly aligns with forecasts from major banks and property research groups, including ANZ, Domain, PropTrack and SQM Research, with the majority of forecasters expecting national home values to rise again in 2026, albeit at a more moderate and uneven pace than in recent years.

Cotality’s December Home Value Index recorded price growth across every capital city and regional market in 2025, with national dwelling values rising 8.6%, adding around $71,400 to the median home value.

Cotality Australia Research Director Tim Lawless said conditions softened toward the end of the year as affordability pressures intensified and expectations around interest rates shifted.

“Housing conditions were strong for most of 2025, which explains the broadly positive sentiment,” Lawless said.

“However, national averages mask increasingly wide variation at the local level, and it’s those differences that are becoming more important as affordability constraints and policy settings diverge.”

Smaller States tipped to outperform

Queensland, Western Australia and South Australia continue to stand out as the most positively viewed markets entering 2026, both among industry respondents and external forecasters.

Cotality survey results show 89% of Queensland respondents expect prices to rise, with more than half anticipating growth above 5%.

That optimism is echoed by forecasts from ANZ, Domain and SQM, which expect Queensland to remain one of the stronger-performing markets nationally, supported by population growth, tight rental conditions and ongoing housing shortages.

Western Australia also features prominently in forecasts, with SQM Research projecting some of the strongest percentage gains nationally, while Domain and ANZ expect Perth prices to continue rising, albeit at a steadier pace than in 2025.

Broad-based demand across price points and relatively affordable entry levels are expected to support further growth.

South Australia’s outlook remains underpinned by relative affordability and limited new supply. Most major forecasters expect Adelaide dwelling values to rise again in 2026, though generally at a more moderate pace compared with Queensland and Western Australia.

“Strong internal migration, tight rental markets and a persistent undersupply of housing continue to support these markets,” Lawless said.

“Those fundamentals largely remain in place, which helps explain why both agents and forecasters remain optimistic about price growth across much of the country outside the east coast’s largest cities.”

NSW and Victoria face tighter constraints

While sentiment in New South Wales remains positive, expectations are increasingly conditional. High dwelling values, stretched borrowing capacity and sensitivity to interest rate movements are expected to limit the pace of growth.

ANZ, Domain and PropTrack all forecast continued price increases in Sydney in 2026, though at a more moderate pace than recent years, reflecting affordability ceilings and rising listings.

Victoria continues to lag national performance after recording the weakest growth among the states in 2025. Although most forecasters still expect Melbourne home values to rise in 2026, expectations remain subdued relative to other capitals.

Higher property taxes, reduced investor participation and softer population growth continue to weigh on confidence, despite first home buyers accounting for a larger share of lending.

“Victoria stands out for the scale of investor selling, policy settings and higher holding costs, all of which have dampened activity,” Lawless said.

“While prices are still expected to trend higher, most forecasters see Victoria underperforming the national average again in 2026.”

First home buyer support lifts activity, but affordability bites

More than 75% of real estate agents reported increased activity following the expansion of the First Home Guarantee, with competition intensifying around scheme price thresholds.

Federal Treasury data shows more than 21,000 first home buyers have accessed the expanded 5% deposit scheme since October*.

However, affordability remains a key constraint, with fewer than half of Australian suburbs now priced below First Home Guarantee caps, a sharp decline from a year earlier.

Confidence holds, but risks are building

While expectations for price growth remain broadly positive across most forecasts, confidence is becoming more conditional as affordability ceilings, interest rate uncertainty and uneven regional dynamics shape the outlook.

“The market enters 2026 from a position of strength, and the majority of forecasters still expect dwelling values to rise,” Lawless said.

“However, affordability challenges, interest rate uncertainty and policy settings are likely to cap the pace of growth, particularly in higher-priced markets.

“With no material supply response expected in 2026, tight housing conditions should help offset downside risks, but outcomes will increasingly depend on local market dynamics rather than national trends.”

From the shacks of yesterday to the sculptural sanctuaries of today, Australia’s coastal architecture has matured into a global benchmark for design.

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.