Luxury Buyers Drifted North, But the Tide May Be Turning

New data shows Sydney and Melbourne underperformed during the lifestyle-migration boom, but shifting price gaps suggest prestige buyers may be circling back.

Australia’s luxury housing map has been flipped on its head over the past five years, but the pendulum may finally be swinging back toward the big cities.

According to Ray White Group Senior Data Analyst Atom Go Tian, the pandemic years reshaped where prestige buyers put their money.

“If you were speaking about luxury houses five years ago, you wouldn’t even consider markets outside of Sydney and Melbourne,” he says.

But when COVID accelerated lifestyle migration and buyers were suddenly free to look elsewhere, the country’s wealthiest house hunters proved highly mobile.

“Luxury buyers proved themselves to be the most flexible and flocked away to where luxury was still sold at a discount,” Tian says. The result: Sydney and Melbourne were largely overlooked while regional prestige markets surged.

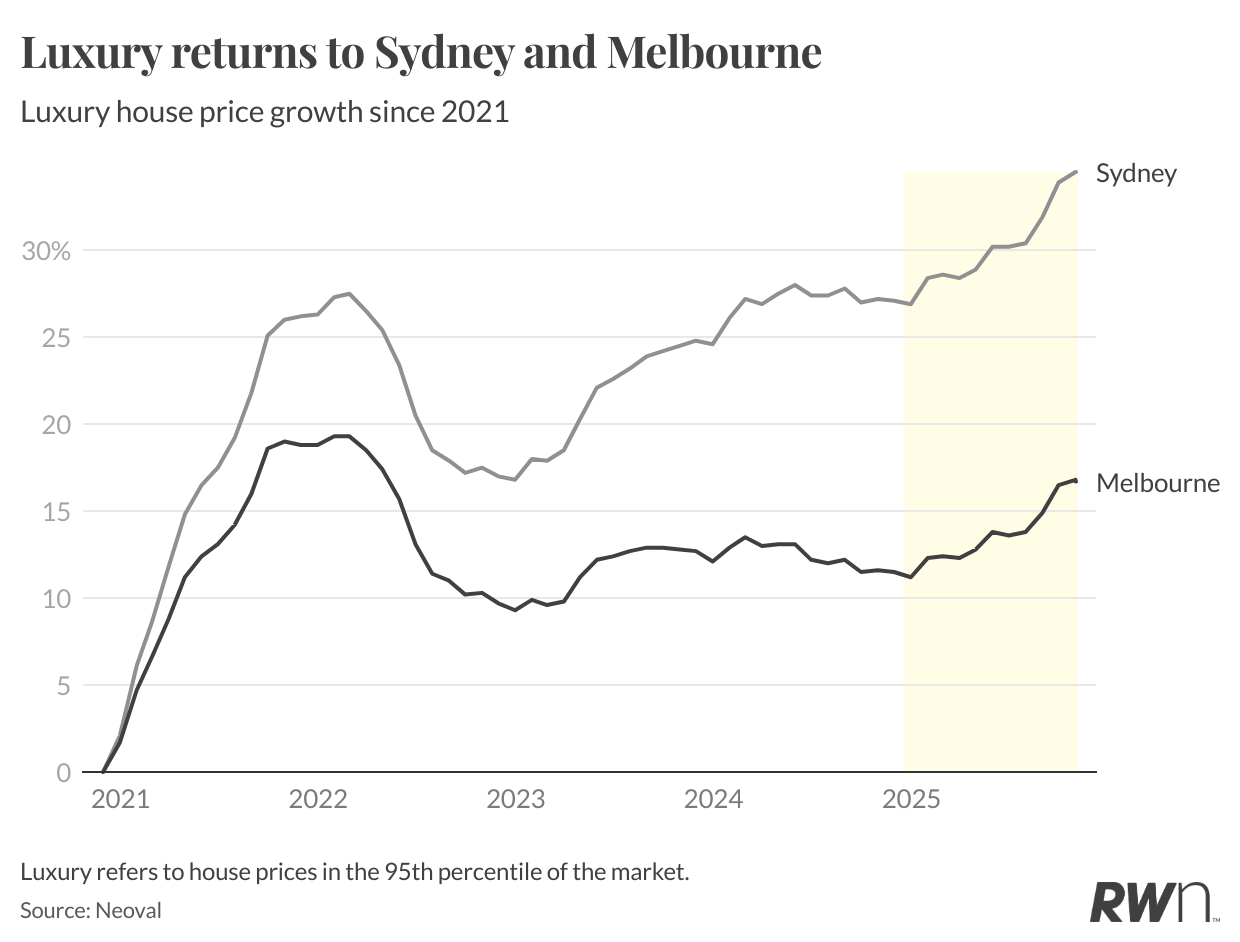

Both major cities saw their luxury prices spike briefly in 2021 as the COVID boom lifted the entire country, but the gains evaporated almost as quickly.

Rising interest rates and the lure of discounted luxury in the regions saw Sydney and Melbourne lose roughly half their 2021 uplift the following year.

The recovery since has been patchy. Tian says Sydney “grew six per cent between 2024 and 2025 after growing just two per cent between 2023 and 2024 to finally reach a new peak luxury price of $4.5 million”.

Melbourne, meanwhile, still hasn’t clawed back its pandemic peak. Luxury prices there rose five per cent between 2024 and 2025 after falling one per cent the year prior, ending 2025 at $2.6 million.

Over five years, the two major cities have been dwarfed by the east-coast lifestyle markets that stole their thunder. Sydney grew 35 per cent and Melbourne just 17 per cent.

Over five years, the two major cities have been dwarfed by the east-coast lifestyle markets that stole their thunder. Sydney grew 35 per cent and Melbourne just 17 per cent.

Compare that with Brisbane (+77 per cent), Perth (+76 per cent), Adelaide (+73 per cent), the Gold Coast (+72 per cent), and the Sunshine Coast (+68 per cent).

That surge allowed the Sunshine Coast ($2.76 million) and Gold Coast ($2.86 million) to overtake Melbourne ($2.62 million) as the second and third most expensive luxury markets in the country.

Brisbane ($2.32 million) and Perth ($2.30 million) are now only 12 per cent cheaper than Melbourne, a huge shift from 2020 when both were 43 per cent cheaper.

Many assumed this decentralised luxury map was the new normal. But Tian says the last 12 months hint at a potential reversal.

“It’s easy to assume the new normal is a decentralised luxury market, but if the last 12 months signal what’s to come, luxury buyers may just be beginning to rediscover the value of Sydney’s prestige waterfront streets and Melbourne’s leafy inner suburbs.”

The price gaps that once tempted buyers north and west have narrowed. In 2020, Sydney was twice as expensive as the Gold Coast and Sunshine Coast.

Now the gap is closer to 1.5 times. Against Brisbane and Perth, the premium has shrunk from 2.5 times to 1.9. “Sydney’s premium looks more justified than overpriced,” Tian says.

Melbourne is a more complicated story. Its long lockdowns hit confidence harder than anywhere else, sending affluent buyers to other states. But Tian believes that weakness may now be its strength.

“At only 17 per cent growth over five years, it significantly underperformed relative to its fundamentals as Australia’s second-largest city.”

If interest rate cuts arrive and confidence lifts, he says the very buyers who abandoned Sydney and Melbourne could return to find relative value they haven’t seen in years.

A resurgence in high-end travel to Egypt is being driven by museum openings, private river journeys and renewed long-term investment along the Nile.

In the lead-up to the country’s biggest dog show, a third-generation handler prepares a gaggle of premier canines vying for the top prize.

The new Brooklyn Tower, a mix of luxury condos and rentals, rises from the historic Dime Savings Bank building.

Listing of the Day

Location: Downtown Brooklyn, New York

Price: $16.75 million

Boasting 360-degree panoramic views across New York City, this new 92nd-floor penthouse is the highest residence in Brooklyn.

The full-floor apartment stands atop the new Brooklyn Tower, which encompasses 143 condos and 398 rentals in the heart of downtown Brooklyn, said Katie Sachsenmaier, senior sales director, Corcoran Sunshine Marketing Group.

The condos begin on the 53rd floor, and the penthouses begin on the 88th floor. This one, Penthouse 92, is the only full-floor penthouse.

“The building is coming into its own now,” she said. “It feels very busy when you step into the lobby.”

Developed by Silverstein Properties, the building at 85 Fleet Street rises from the historic Dime Savings Bank building, according to a news release.

It was designed by SHoP Architects with interiors curated by Gachot Studios, and it is the borough’s only super tall skyscraper.

Penthouse 92 features custom interiors by Brooklyn-based Susan Clark of design firm Radnor, Sachsenmaier said. “Her selections have made it really beautiful. It feels very warm and inviting.”

Architectural details include 12-foot ceilings, European white oak floors in a custom honey stain, mahogany millwork, bronze detailing and floor-to-ceiling windows.

The eat-in kitchen features Absolute Black stone countertops, an island with seating, oil-rubbed bronze Waterworks fixtures and integrated Miele appliances, according to the listing.

The primary en suite bathroom showcases large-format Honed Breccia Capraia marble. There is also a separate laundry room as well as a wet bar and a butler’s pantry.

The views are spectacular, Sachsenmaier said. “If you’re standing in the living room, you take in the Statue of Liberty and all the way up through Midtown. On a clear day, you can see the planes take off at LaGuardia (Airport).”

Photo: Sean Hemmerle

Moving around the apartment, you see south over the harbor and then north and east over the whole city, she said.

From the front door, “you’re immediately greeted with the expansive living room and the view,” she said. “It’s really the first thing you see.”

The primary suite features a dressing room, multiple walk-in closets, two bathrooms (one with a cedar sauna) and southwest-facing windows, Sachsenmaier said. “You get those really beautiful harbour views.

The amenities will be ready by the end of summer, she said. A Life Time club will occupy the entire sixth and seventh floors, and an outdoor pool deck wraps around the dome of the bank building.

Stats

The 5,891-square-foot home has four bedrooms, five full bathrooms and one partial bathroom.

Amenities

Residents will have access to over 100,000 square feet of exclusive indoor and outdoor leisure spaces.

Fitness company Life Time will manage an array of amenities that include a 75-foot indoor lap pool, outdoor pools, a poolside lounge and atrium, a billiards room, a library lounge, a conference room, a theatre with a wet bar, a children’s playground and playroom and limited off-site parking.

The Sky Park offers an open-air loggia with a basketball court, foosball, a playground and a dog run.

Photo: Gabriel Saunders

Neighbourhood Notes

Downtown Brooklyn is at the centre of a number of neighbourhoods, including Fort Greene, Cobble Hill, Boerum Hill and Brooklyn Heights. The tower has access to 13 subway lines, 11 commuter trains, the city’s ferry network and 22 Citi Bike stations.

“You can walk to Fort Greene Park in less than 10 minutes,” and Dekalb Market Hall, which has a Trader Joe’s, a Target and a food hall, is “right next door,” Sachsenmaier said.

Agent: Katie Sachsenmaier, senior sales director, Corcoran Sunshine Marketing Group

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.

A resurgence in high-end travel to Egypt is being driven by museum openings, private river journeys and renewed long-term investment along the Nile.