The stairway to heaven for wine lovers

Home cellars have become the latest must-have for those who value their collection and love to entertain

Tony Hayek first became interested in wine as a student at Newcastle University. Living adjacent to one of Australia’s best known wine growing regions, the Hunter Valley, for a while he dated a woman who worked in the industry and taught him what she knew.

He has been hooked ever since.

“Over the next 25 years, I collected wine in drinkable quantities,” he says. “As I became wealthier, I started buying wine in batches of six — I’d drink one or two and put the others away — but I didn’t really have anywhere to store them so it capped out at 300 or 400 bottles.”

In his former home, he turned a workshop under the house into a wine cellar of sorts. It wasn’t temperature controlled but it allowed him to enjoy his wine when and where he wanted. But when he and his wife Toni had the chance to build their dream home in Sydney’s north west in 2017, plans for a cellar were a bit basic.

“The builder engaged a cabinetmaker to put together a plan for a wine cellar but it was a bit boring — mostly just shelving,” Hayek says.

Instead, the couple hired kitchen and bathroom design specialists, Studio Minosa.

“They did this magnificent design,” Hayek says. “I was still recovering from the cost of building when the Minosa quote came in at $150,000 so I initially put it on the backburner. Finally, I bit the bullet and we got it done in 2020.”

As a result, Hayek says much of his time at home during the pandemic was spent below ground.

“It’s my ‘pinch myself’ room,” he says. “Every time I walk in there, I can’t believe it’s in my house. I spent a lot of my COVID time researching wine. That was how I stocked my cellar and it went from 400 to 800 bottles. I want to know what’s in my cellar and have a relationship with it.”

While Tania MacPhee, managing director of MacPhee’s wine cellaring specialists, says wine cellars were becoming more popular prior to the pandemic, demand grew even further during lockdown when people used their untapped travel funds to create wine spaces they could enjoy.

“We started as an off-site wine storage business 22 years ago. Since then, the market has absolutely shifted,” she says. “Where wine cellars back then were predominately functional spaces in the basement or garage, today, wine enthusiasts are wanting to proudly display their wine collections, making them a feature of their home.”

She says the demand for purpose-built cellars has been driven by an educated audience who travel regularly and appreciate the value of a good drop. For those who have invested heavily, it’s important to keep wines in optimum conditions.

The challenge is maintaining an even temperature range to avoid wine “spoiling”, which alters its taste, smell and the consumer’s overall enjoyment. In wine making regions in Europe, the ideal temperature range around 12 to 14 degrees may be achievable without refrigeration due to their cellars being two metres below the earth, but MacPhee says it’s virtually impossible to guarantee in Australia where our cellar spaces are often beside a garage and under a concrete slab, acting as a hot box in summer — and a freezer in winter. “It’s the fluctuation in temperature that is detrimental to wine.”

“While a basement might seem cool at 26 degrees compared with hot Summer temperatures outside, it’s still not cool enough for wine,” she says.

For those who don’t have the space for a full cellar, or would rather have their wines on display, MacPhee says ‘wine walls’ are a popular choice.

“People are going to beautiful restaurants where they have these wine walls where guests can see individual bottles of wine,” she says. “And they want to recreate that in their homes.”

Wine walls are typically two or three metres wide and at least 600mm deep, she says.

“Depending on the location of the wine cellar relative to the rest of the home, $20,000 is the starting point for a very basic climate controlled space with insulation,” she says. “A wine wall with bespoke cabinetry can cost between $80,000 and $100,000 or more.”

“All wine needs to be cellared at the same temperature but when it comes to drinking, it is only then that individual wine varietals should be served at different temperatures”, MacPhee says. Some wine fridges provide two temperatures, in two separate zones. There’s even an under bench wine cabinet which is designed for the kitchen.

“It has multiple temperatures all in one zone, where you can place champagne at the bottom at six degrees, then Aromatic whites on the shelf above at 8 degrees, then it gradually goes up to 18 degrees for your heavy bodied reds.” she says. “We call it the ‘instant gratification wine cabinet’.”

General manager at Gaggenau, Robert Warner says wine lovers are investing in larger quantities of high quality wines so it simply makes sense that they are looking for accessible storage options at home.

“If you are buying a $100 bottle of wine and then you decide to buy the whole case, that’s $1200,” he says. “Do you want to risk it going off in a year or two because you haven’t stored it properly?”

He admits there is more to it than having your favourite drop within easy reach and ready to drink.

“There’s a bit of theatre to it,” he says. “It’s a lifestyle and interaction with like-minded people. Luxury living is about being personalised while still feeling connected with other people.”

Pure Amazon has begun journeys deep into Peru’s Pacaya-Samiria National Reserve, combining contemporary design, Indigenous craftsmanship and intimate wildlife encounters in one of the richest ecosystems on Earth.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

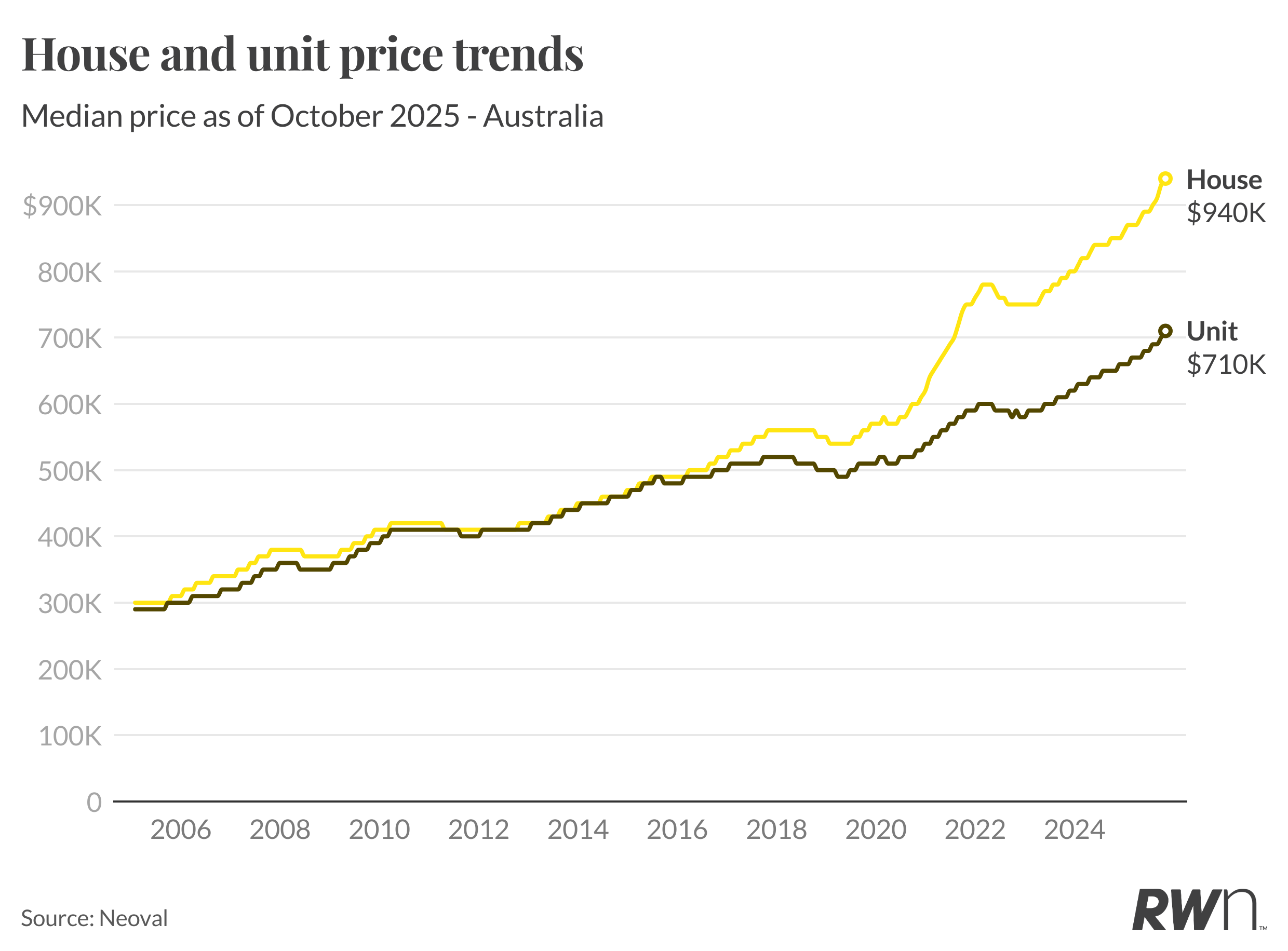

Australian house prices are surging again, delivering double-digit annual growth months ahead of schedule.

Nationally, the median house price climbed 1.1 per cent in October to $940,000, lifting annual growth to 10.6 per cent, the first double-digit increase since the 2021–22 property boom.

Market Resilience Surprises Analysts

The acceleration comes earlier than expected, according to Ray White Group Chief Economist Nerida Conisbee, who says the milestone was originally forecast for the end of the year.

“Stronger-than-expected October gains and continued tight supply across most markets have pushed growth ahead of schedule,” Conisbee said. “This shows how resilient demand has remained through spring.”

Perth (+14.8 per cent), Brisbane (+12.5 per cent) and Adelaide (+10.8 per cent) continue to lead the charge among capital cities, while Sydney (+8.6 per cent) and Melbourne (+6.5 per cent) show steady, consistent increases.

Regional Markets Extend Their Lead

Beyond the capitals, regional Australia is powering ahead, particularly in the resource states.

Regional Western Australia jumped 16.4 per cent year-on-year, and regional Queensland followed close behind at 14.5 per cent, as population growth and affordability continue to drive demand.

Units Outperform Houses

Unit prices rose even more sharply in October, up 1.4 per cent to $710,000, marking 9.2 per cent annual growth. Conisbee said affordability pressures, new first home buyer incentives, and a lack of available stock are pushing more buyers into the apartment market.

“Units are now seeing stronger monthly gains than houses, reflecting both affordability constraints and renewed first-home-buyer activity,” she said.

The biggest monthly jumps were in Perth (+1.6 per cent), Adelaide (+1.5 per cent), and Brisbane (+1.4 per cent). Melbourne’s unit market also firmed, up 1.6 per cent, as buyers returned to lower price brackets.

Spring Demand Defies Higher Listings

Despite an influx of spring listings, new stock has failed to match the intensity of buyer demand. Nationally, house prices have now risen every month since February, and unit prices every month since March.

“The pace of growth shows demand hasn’t been dampened by higher supply,” Conisbee said.

Outlook: Steady Growth Into 2026

The data comes as the Reserve Bank prepares for its Melbourne Cup Day meeting, where rates are expected to remain on hold at 3.6 per cent.

With inflation easing only gradually and unemployment sitting around 4.5 per cent, analysts expect monetary policy to stay steady for now.

Ray White’s forecast suggests 2025 will close with high single- to low double-digit annual growth nationally, with smaller capitals and regional areas tipped to outperform well into 2026.

With two waterfronts, bushland surrounds and a $35 million price tag, this Belongil Beach retreat could become Byron’s most expensive home ever.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.