Home-Buying Companies Stuck With Hundreds of Houses as Demand Slows

As mortgage rates surged, some customers backed out of purchases or needed more time for financing

Ribbon Home Inc. had a fast-growing business during the housing boom. The New York City-based startup purchased homes with cash on behalf of buyers. Then it sold the homes to the buyers at the same price, plus a fee, once the buyers got a mortgage.

This approach made their clients’ offers more appealing, since sellers often prefer all-cash transactions that can close quickly and are considered more reliable. Ribbon has been active in hot markets such as Atlanta and Charlotte.

But last year as mortgage rates surged, some Ribbon customers backed out of their purchases or needed more time to get financing. That left the company owning nearly 400 homes, according to property records analysed by research firm Attom Data Solutions and confirmed by the company.

Ribbon is one of a handful of young companies known as power buyers. These firms created a niche business around helping home buyers gain an edge during the hyper competitive housing boom. Now that the market has cooled, some of these companies are stuck with hundreds of homes they acquired on behalf of clients.

Orchard Technologies Inc., another power buyer that has been active in places such as Denver and Dallas, helps customers buy a new home and move before selling their previous home. If clients can’t sell their homes after four months, Orchard agrees to buy them.

The company now owns about 200 homes its customers were unable to sell, said its Chief Executive Court Cunningham. Mr. Cunningham said Orchard has had to buy homes from customers three times as frequently over the past six months.

The unanticipated glut of homes these firms are carrying is an example of how housing-oriented companies that thrived when mortgage rates were super low are struggling to survive in a higher rate environment.

Online home-flipping companies also experienced turbulence as rates surged. Opendoor Technologies Inc. last year slashed prices on thousands of homes it purchased near the height of the market. The company reported huge losses and laid off 18% of its workforce.

Ribbon has let go of about 170 employees, or 85% of its staff, but it still needs to unload its surplus of houses. About half of those homes Ribbon will try to sell on the open market because their customers didn’t follow through on their purchases. People backed out because they didn’t want to sell their current homes in a down market, had credit issues or had a life event that changed their plans, said Shaival Shah, Ribbon’s chief executive.

The other half the company hopes to sell to the original customers. Most of those customers are renting from Ribbon, and some have asked for more time to obtain financing, Mr. Shah said.

Some power buyers say they are optimistic the housing market can stabilise, and recently there have been a few signs that buying may be picking up.

Power buyers say that their business will continue to serve home buyers in competitive markets and help even the playing field with investors, who often purchase homes with cash. Meanwhile, many are focused on improving products aimed at prospective sellers who are nervous to list their homes in a slow market.

“There was sort of a power shift, from the power sitting with the seller knowing that their home is going to sell within a day, to the power sitting with the buyer,” said Tim Heyl, founder of the Austin-based power buyer Homeward Inc.

Ribbon, which halted its cash-buyer program last year, said it is developing new products before it restarts. HomeLight Inc., another power buyer, recently changed up one of its main offerings so that it wouldn’t buy as many homes moving forward, said Drew Uher, the company’s chief executive.

Mr. Cunningham, of Orchard, said his company has reduced losses from homes it acquired by charging customers fees on both the sale of their previous homes and the purchase of their new homes. He said seller demand for backup offers from Orchard is rising given ongoing uncertainty about home sales.

Some executives said they don’t expect every power buyer to survive. Many relied on venture capital to grow during the height of the housing market, but they are unlikely to raise as much money now. Between January and late November 2022, venture investment in proptech companies decreased 21% compared with the same period the year prior, according to a report from Keefe, Bruyette and Woods Inc.

“People were doing all sorts of things to outbid or be the most competitive offer,” said Diane Vanna, a real-estate agent at Baird & Warner in Chicago, who in 2021 represented a buyer who won a bidding war against 36 other offers. “Now it’s really levelled off.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Formula 1 may be the world’s most glamorous sport, but for Oscar Piastri, it’s also one of the most lucrative. At just 24, Australia’s highest-paid athlete is earning more than US$40 million a year.

From gorilla encounters in Uganda to a reimagined Okavango retreat, Abercrombie & Kent elevates its African journeys with two spectacular lodge transformations.

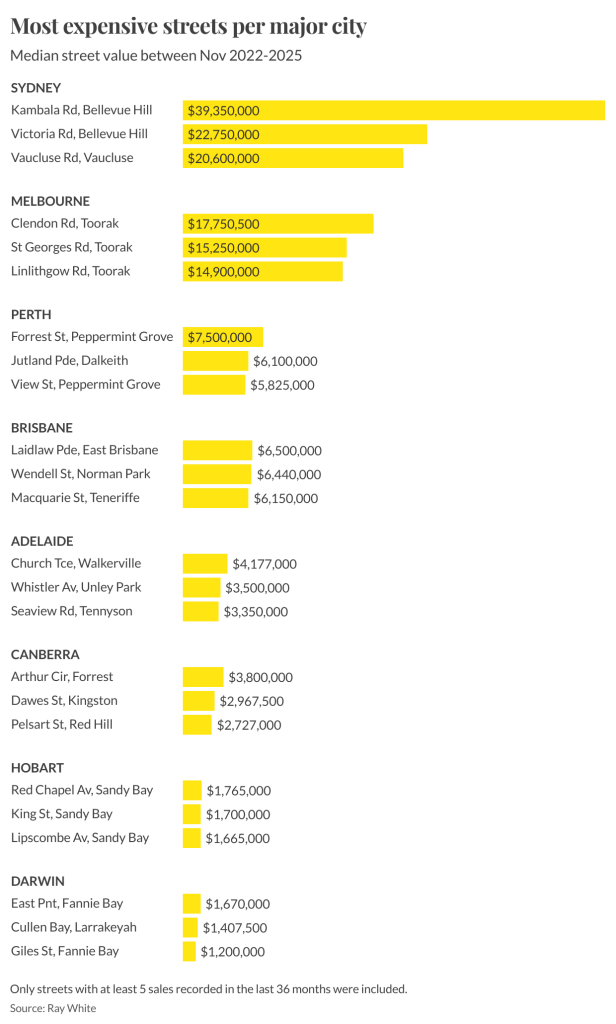

Ray White senior data analyst Atom Go Tian says Sydney’s elite postcodes are pulling further ahead, with Bellevue Hill dominating the nation’s most expensive streets in 2025.

Sydney has cemented its status as the nation’s luxury capital, with Kambala Road in Bellevue Hill being Australia’s most expensive street this year, posting a median house price of $39.35 million.

And, according to Ray White senior data analyst Atom Go Tian, last year’s leader, Wolseley Road, was excluded from this year’s rankings due to limited sales.

“Wolseley Road recorded only three sales this year and was therefore excluded from the rankings, though its $51.5 million median would have otherwise retained the top position,” he says.

Bellevue Hill continues its dominance, accounting for six of the nation’s top 10 streets. Tian says the suburb’s appeal lies in its rare blend of location and lifestyle advantages.

“The suburb’s enduring appeal lies in its rare combination of proximity to both the CBD and multiple beaches, harbour views, and large estate-sized blocks on tree-lined streets.”

Vaucluse remains a powerhouse in its own right. “Vaucluse extends this harbourside premium with even more direct beach access and panoramic water views,” he says.

The gulf between Sydney and the rest of the country remains striking.

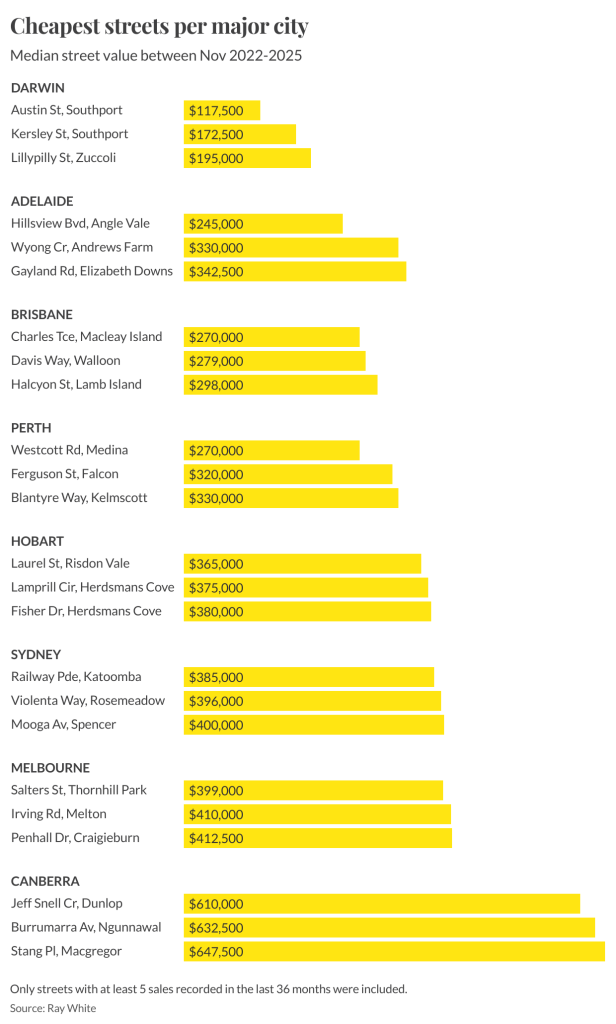

According to Tian, “Sydney’s most expensive streets are more than five times more expensive than the leading streets in Perth and Brisbane, and more than 10 times the premium streets in Canberra and Adelaide.”

He attributes this to Sydney’s economic role and geographic constraints, describing it as “Australia’s financial capital and its most internationally connected city.”

Beyond Sydney, each capital city has developed its own luxury hierarchy. Tian highlights Melbourne’s stronghold in Toorak, noting that “Melbourne’s luxury market remains centred around Toorak, led by Clendon Road, St Georges Road and Linlithgow Road.”

Brisbane’s prestige pockets are more dispersed: “Brisbane’s luxury real estate shows a more diverse pattern,” he says, led by Laidlaw Parade at $6.5 million. Perth’s top-end market remains anchored in the Peppermint Grove–Dalkeith corridor, with Forrest Street at $7.5 million.

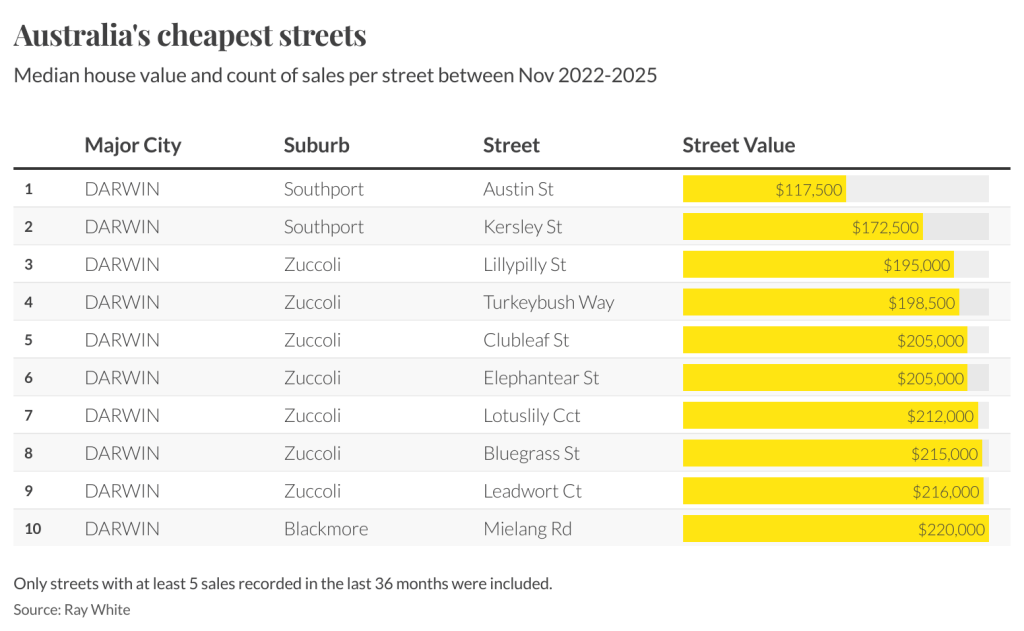

He also points to the stark contrast at the lower end of the spectrum. “Darwin presents a mirror image, hosting all 10 of the country’s cheapest streets,” Tian says. Austin Street in Southport sits at just $117,500.

The national spread reaches its extreme in New South Wales. “Sydney emerges as the most polarised market, spanning an extraordinary range from Railway Parade in Katoomba at $385,000 to Kambala Road’s $39.35 million,” Tian says.

Methodology: Tian’s analysis examines residential house sales between November 2022 and November 2025, with only streets recording at least five sales included. Several streets with higher medians, including Black Street, Queens Avenue and Clairvaux Road in Vaucluse, were excluded because they did not meet the sales threshold.

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?

Australia’s market is on the move again, and not always where you’d expect. We’ve found the surprise suburbs where prices are climbing fastest.