The designer’s Mind: Delving into the Best Interior Design Books

There’s no shortage of design inspiration online but nothing beats the joy of spending an afternoon immersing yourself in a good interior design book. Edited, carefully curated and, above all, designed, these titles take you behind the scenes of some of the world’s most beautiful interiors in a considered way. Think of it like the difference between listening to a few tunes on Spotify versus releasing a thoughtfully crafted studio album. We’ve assembled our top six of interior design books on the market right now for your viewing and reading pleasure.

1. Interiors beyond the primary palette

Step inside the world of award-winning interior design duo Juliette Arent and Sarah-Jane Pyke in this, their first compendium of their work. A ‘best of’ over more than 15 years working together, it’s a masterclass in working with colour and pattern as seen through 18 projects from around the country. With a focus on the idea of home as sanctuary, this hefty tome offers insight into the mind of the designer with points on where to find inspiration, meeting client briefs and the importance of relationships. Thames & Hudson, $120

2 House of Joy

If there was ever a book title for our times, then this is it. With a subtitle of Playful Homes and Cheerful Living, this book champions fun in interior design, with bold and bright homes from around the world to delight and inspire. While there’s a good dose of the unexpected, like a disco ball in the garden, there’s no mayhem in these spaces. Instead, they’re beautifully executed to tempt even the most colour shy. Gestalten, $105

3. Abigail Ahern Masterclass

Some design books are beautiful to look at, and that’s it. This is not one of those books. A master of colour and pattern, UK designer Ahern offers a practical foundational guide to beautiful interiors, mixing form with function in her latest book, Masterclass. Find the inspiration you need to create a gorgeous home. HarperCollins, $65

4. Interiors Now!

Looking for a visual crash course in international design trends with longevity? This is the book for you. Featuring homes across the globe, from New York to Auckland via Avignon, the biggest dilemma for readers is settling on a style. Many of the projects are owned by designers and creatives, lending a dynamic edge to this tome, now in its 40th year. Taschen, $50

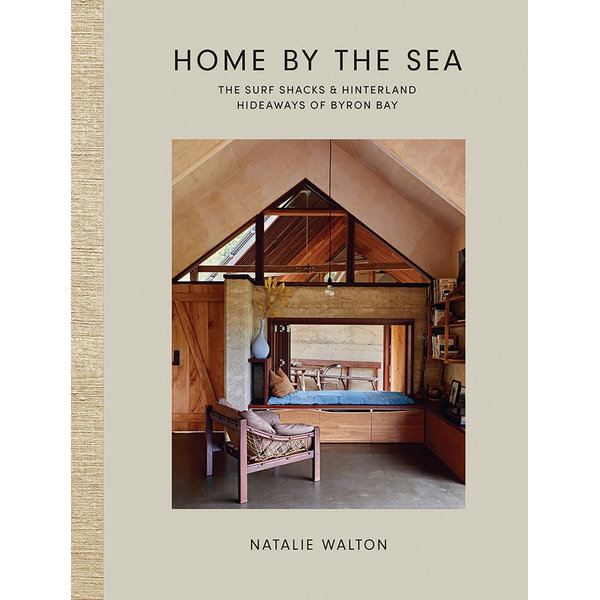

5. Home by the Sea

For many Australians, the ocean holds an almost hypnotic appeal. Home by the Sea by Natalie Walton lets you imagine, for a little while at least, what it’s like living the dream in a beach shack in Byron Bay. The book tours 18 homes in and around the region and the hinterland owned by artists, designers and makers. With photography by Amelia Fullarton, it champions the good life. Hardie Grant, $60

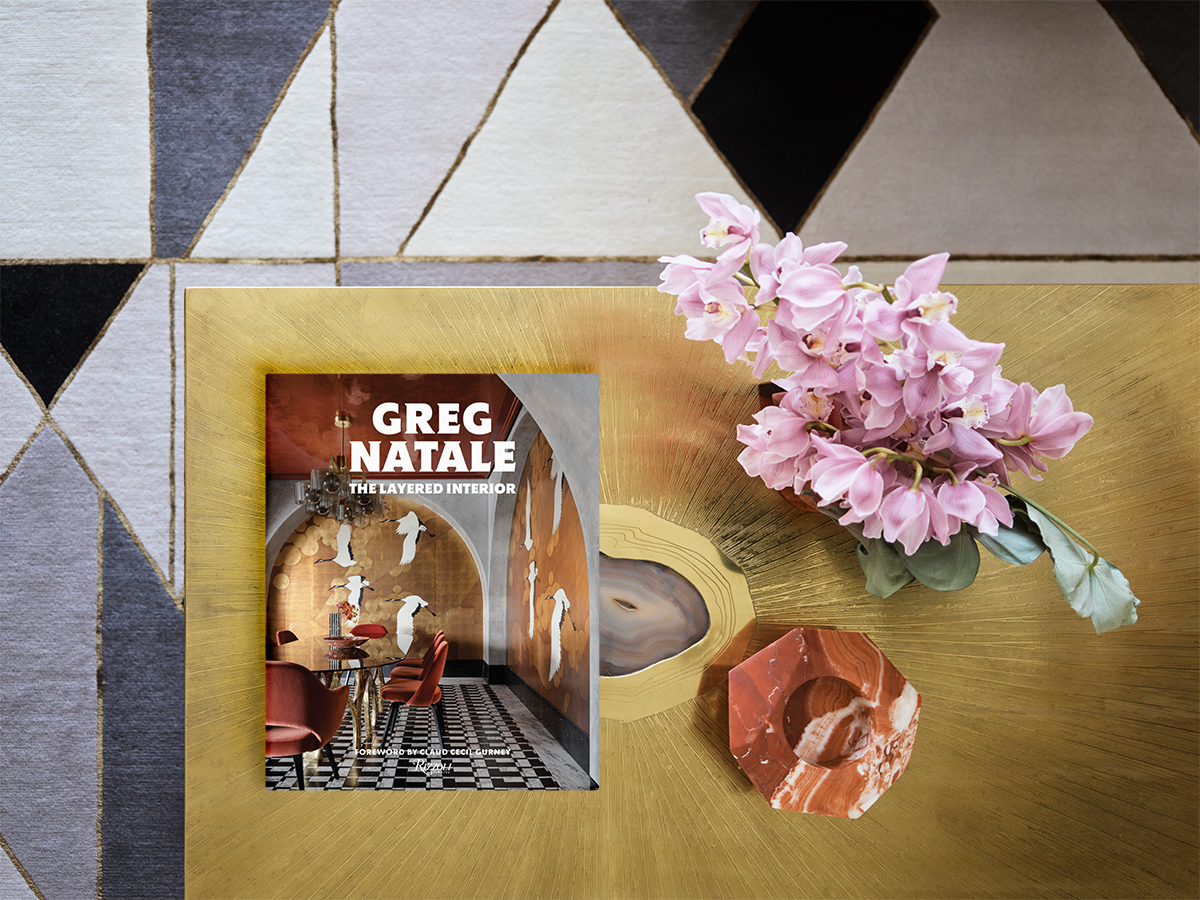

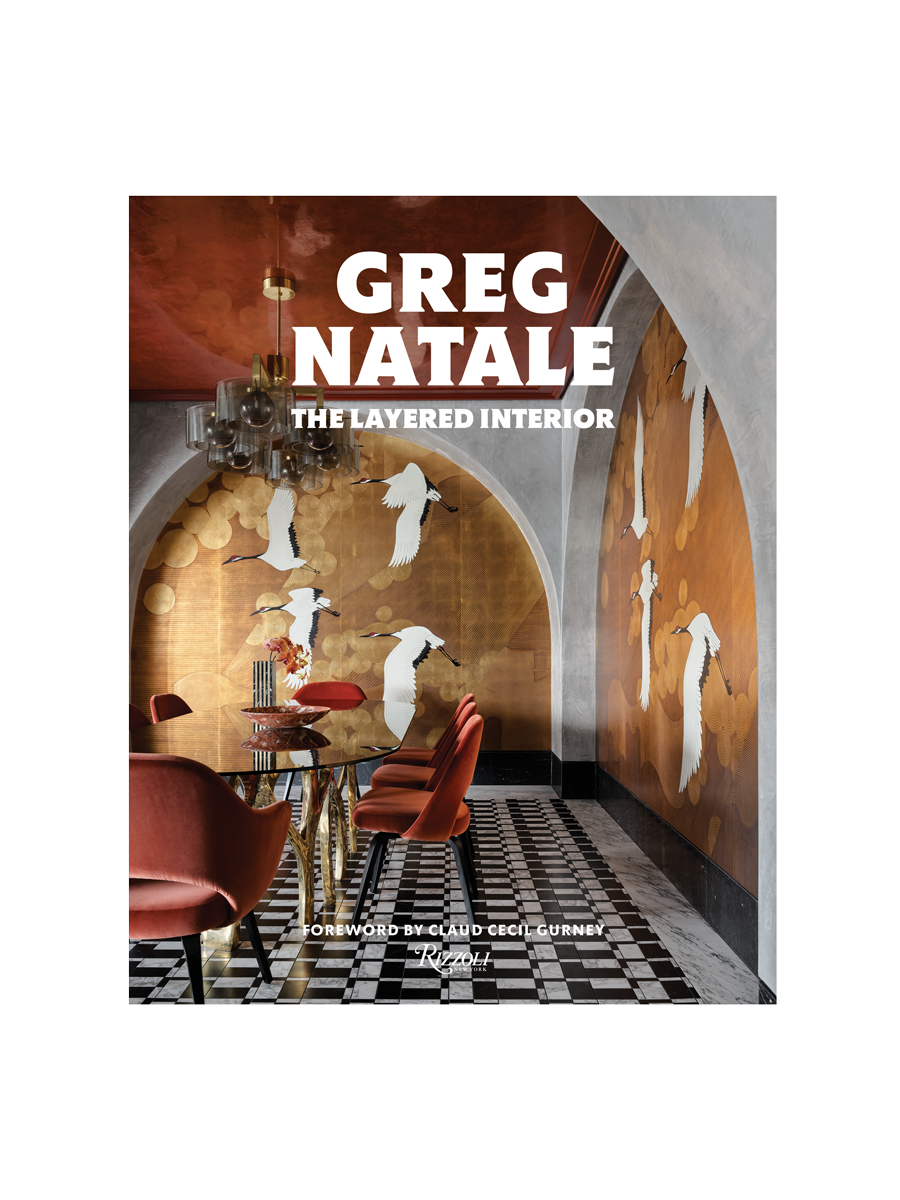

6. The Layered Interior

Released last year, this is the third volume from award-winning interior designer Greg Natale. Different in format from his earlier books, the eight projects featured are Australian but with a slight Euro-centric focus. The writing is conversational, almost intimate, inviting the reader into the most luxurious spaces beautifully captured by photographer Anson Smart. This coffee table tome is perfect for dreamers and doers alike. Rizzoli, $110

How can I improve my interior design knowledge?

To be an interior designer, most people have completed a bachelor’s degree or advanced diploma. However, anyone can improve their interior design knowledge by listening to or reading about the design process, as well as taking short courses in design from a reputable design school. Look for online tutorials or interior design books that provide step-by-step guides to creating beautiful spaces and follow interior design social media accounts to get you started. If you want to learn more, you can contact industry bodies such as the Design Institute of Australia for next steps.

What should I read for interior design?

While interior design is often considered a visual medium, there is a lot to understand about the way spaces flow and the balance of materials required. If you have a casual interest, look for design books that appeal to your personal style, which will offer tips on using colour, pattern and texture. For further information, opt for books explaining the main principles of interior design which will discuss questions of balance, scale and proportion, as well as form and function.

Can I teach myself interior design?

In an age where information on most topics is widely available online, yes, you can teach yourself the rudimentaries of interior design. However, a reputable course or degree will provide you with set tasks to test your knowledge and skills before going out into real world experiences. There are several options to qualify as an interior designers, including university and TAFE courses, as well as private colleges.

As the season turns, Handpicked Wines’ latest Pinot Noir and Chardonnay releases reveal how subtle shifts in place shape what ends up in the glass.

Exclusive eco-conscious lodges are attracting wealthy travellers seeking immersive experiences that prioritise conservation, community and restraint over excess.

Developer lodges plans for a $36 million, design-led apartment building on Edgecliff Road, reinforcing confidence in Sydney’s tightly held eastern suburbs.

Abadeen has lodged plans for a $36 million boutique residential development in Woollahra, marking the next phase of its expansion across Sydney’s most tightly held eastern suburbs.

The proposal, submitted for 101 to 115 Edgecliff Road, would deliver a six-storey building comprising 29 apartments and 50 car spaces on a prominent corner site bounded by Australia Lane and Adelaide Street.

Positioned within walking distance of Woollahra Village and Bondi Junction, the project aims to combine architectural distinction with the convenience of one of the city’s most connected lifestyle precincts.

The development responds to the NSW Government’s low and mid-rise housing reforms, which allow apartment buildings of up to six storeys within close proximity to major transport and retail hubs.

Abadeen said the design incorporates upper-level setbacks and a carefully articulated form to ensure the building remains sensitive to Woollahra’s established character.

Executive Chairman and founder Justin Brown described the site as a natural fit for the company’s long-term strategy.

“Edgecliff Road is a remarkable site close to Woollahra Village and Bondi Junction and exactly the type of well located, tightly held opportunity we seek,” Brown said.

“Our focus has always been to identify, secure and progress sites that deliver enduring value for residents, communities and our investors.”

The proposal follows the successful launch of Abadeen’s Henri House development in nearby Darlinghurst, where construction is now underway.

Chief executive Joe Tack said the strong response to that project reinforced demand for design-led apartments in the eastern suburbs.

“Woollahra is defined by heritage, lifestyle and connectivity, and the Edgecliff Road proposal presents an opportunity to contribute thoughtfully to the suburb’s evolution,” Tack said.

Established in 2000, Abadeen has built a reputation for premium residential and mixed-use developments, with recent projects including KOYO in Crows Nest, ENSO in Neutral Bay and Hampden in Mosman.

The company currently has more than 20 projects in delivery nationwide and a development pipeline exceeding $3.5 billion.

If approved, the Woollahra project would add to a growing wave of boutique developments reshaping Sydney’s eastern suburbs, where limited supply and enduring lifestyle appeal continue to underpin demand.

Chinese carmaker GAC will expand its Australian electric vehicle line-up with the city-focused AION UT hatchback.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.