John McGrath’s Best Suburb Selections for 2025: Where to Invest Next

A new market cycle is commencing as prices rebound in almost every market this Spring

Australian property industry veteran, John McGrath says the next major market upswing is “just over the horizon” amid strong auction clearance rates this Spring and rebounding prices in many areas.

Mr McGrath says he expects greater market activity in 2024 as inflation continues to trend down, thereby bringing an end to the fastest interest rate hiking cycle in decades.

McGrath has just released its annual market report, in which Mr McGrath names his top suburb picks for 2024 across the East Coast of Australia and why these areas are poised for price growth.

Kanebridge News profiles 10 of Mr McGrath’s top suburb picks for 2024 below.

Fairfield, Sydney

Fairfield is one of Australia’s most multicultural communities, making it an attractive place to settle for some of the 715,000 net migrants expected to arrive in Australia over the next two years.

Mr McGrath says the Western Sydney International Airport will create a new local jobs hub when it opens in 2026. He notes that significant medium-density development “has led to affordable homeownership opportunities” for younger buyers, with the median apartment price just $410,000.

Chifley, Sydney

Mr McGrath says Chifley offers a great outdoorsy lifestyle with close proximity to national parks and reserves, walking trails, sports fields, an equestrian club and several golf clubs.

“The neighbourhood has had a facelift in recent years, with young family buyers replacing original houses with new, contemporary residences,” he says. “There is also a much higher-than-average number of semis and townhouses in Chifley, providing more affordable options for buyers.”

Point Cook, Melbourne

Point Cook is a well-established suburb that is packed with amenities and offers great value, with a median house price of $760,000, according to Mr McGrath.

“Prices have remained resilient during the recent downturn, and rents have grown strongly in the past year,” he said. “The suburb … has a good mix of housing stock and its proximity to the water is a big drawcard for residents.”

Spotswood, Melbourne

Spotswood has flown under the radar in the shadow of neighbouring hotspots Seddon and Yarraville, says Mr McGrath.

He points out that Spotswood has a solid track record of price growth and “strong growth fundamentals” for the future, including an expanding dining scene and good road and rail links.

Mansfield, regional Victoria

Mansfield was an extremely popular treechange destination during the pandemic, when many people left Melbourne and moved to the regions because they were able to work remotely.

Mr McGrath says there is still room for Mansfield home values to grow further, pointing out that “price growth has not yet reached the heights of high country lifestyle locations like Bright”.

Clontarf, Brisbane

Located at the southern end of the Redcliffe Peninsula, Mr McGrath says Clontarf was one of the top growth suburbs in the Moreton Bay region in 2023. He says the suburb is highly desirable among family buyers due to its transport links to Brisbane, sprawling beaches and waterfront parks.

Southport, Gold Coast

Southport offers a more affordable price point but the same attractive lifestyle amenities as Broadbeach, Burleigh Heads and Palm Beach. “The plethora of high rises here makes it an attractive option for those who like to live close to the action,” Mr McGrath says.

Coolum Beach, Sunshine Coast

Mr McGrath says Coolum Beach is known for some of the most consistent waves for surfers on the coast. He says the suburb is popular with family buyers and couples and sits in a central location within an easy drive of Sunshine Coast Airport and only 20 minutes south of Noosa Heads.

Moonah, Hobart

About 5km north of Hobart’s city centre, Mr McGrath says Moonah is “an up-and-coming suburb where you can still find houses for less than $650,000.”

He adds: “Its affordability and wide quiet streets make it a magnet for young families, as well as those buying their first home. Another drawcard is its thriving food scene clustered around Main Road, with renowned restaurants like St Albi.”

Riverside, Launceston

On the banks of the Tamar River about 4km from the CBD, Riverside is appealing to family buyers due to its proximity to the city and four local schools.

Mr McGrath says the Riverside market provides the opportunity to buy homes with water views, or homes on larger parcels of land a bit further out where many residents keep horses and chickens.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Australian house prices are surging again, delivering double-digit annual growth months ahead of schedule.

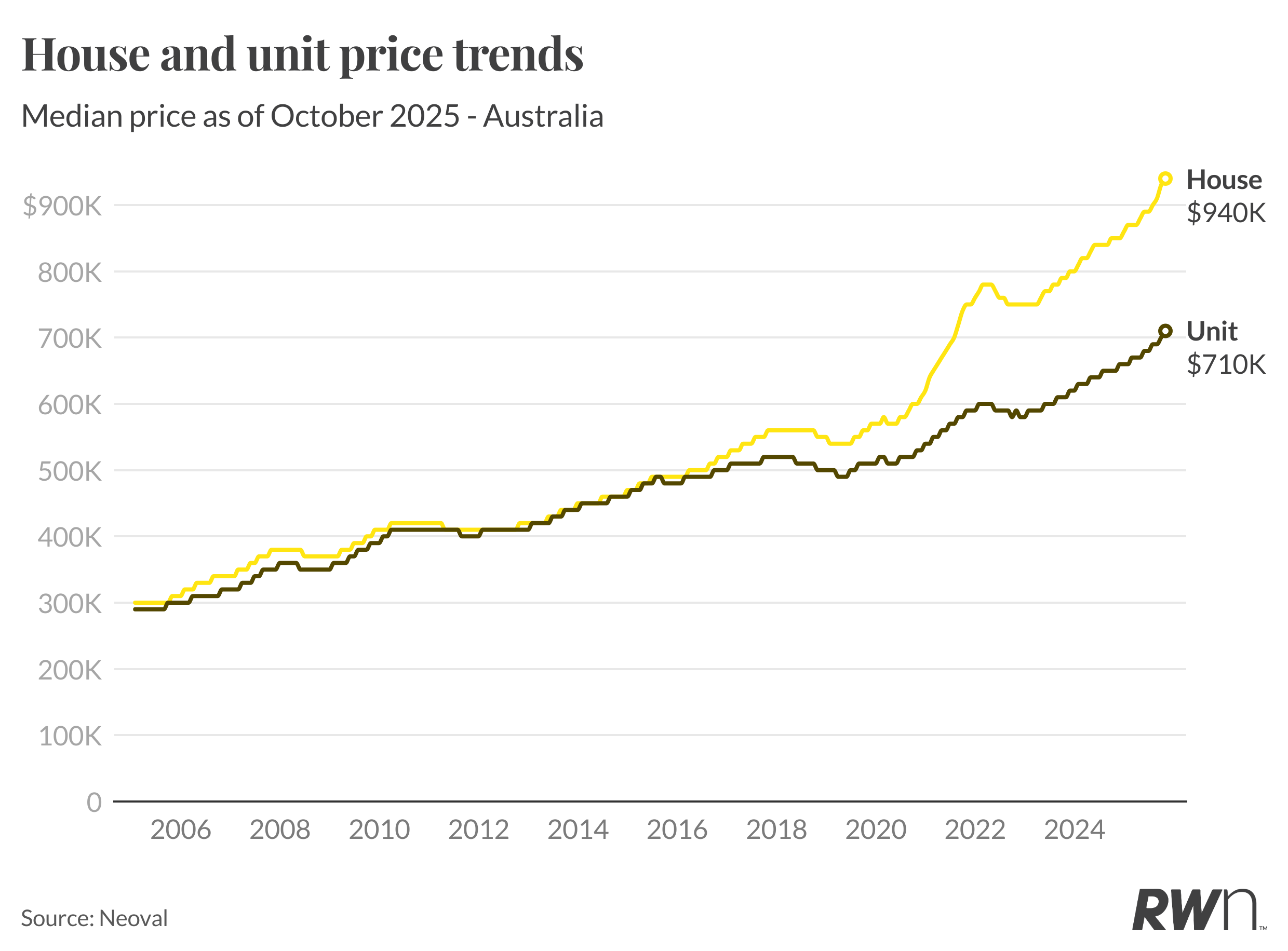

Nationally, the median house price climbed 1.1 per cent in October to $940,000, lifting annual growth to 10.6 per cent, the first double-digit increase since the 2021–22 property boom.

Market Resilience Surprises Analysts

The acceleration comes earlier than expected, according to Ray White Group Chief Economist Nerida Conisbee, who says the milestone was originally forecast for the end of the year.

“Stronger-than-expected October gains and continued tight supply across most markets have pushed growth ahead of schedule,” Conisbee said. “This shows how resilient demand has remained through spring.”

Perth (+14.8 per cent), Brisbane (+12.5 per cent) and Adelaide (+10.8 per cent) continue to lead the charge among capital cities, while Sydney (+8.6 per cent) and Melbourne (+6.5 per cent) show steady, consistent increases.

Regional Markets Extend Their Lead

Beyond the capitals, regional Australia is powering ahead, particularly in the resource states.

Regional Western Australia jumped 16.4 per cent year-on-year, and regional Queensland followed close behind at 14.5 per cent, as population growth and affordability continue to drive demand.

Units Outperform Houses

Unit prices rose even more sharply in October, up 1.4 per cent to $710,000, marking 9.2 per cent annual growth. Conisbee said affordability pressures, new first home buyer incentives, and a lack of available stock are pushing more buyers into the apartment market.

“Units are now seeing stronger monthly gains than houses, reflecting both affordability constraints and renewed first-home-buyer activity,” she said.

The biggest monthly jumps were in Perth (+1.6 per cent), Adelaide (+1.5 per cent), and Brisbane (+1.4 per cent). Melbourne’s unit market also firmed, up 1.6 per cent, as buyers returned to lower price brackets.

Spring Demand Defies Higher Listings

Despite an influx of spring listings, new stock has failed to match the intensity of buyer demand. Nationally, house prices have now risen every month since February, and unit prices every month since March.

“The pace of growth shows demand hasn’t been dampened by higher supply,” Conisbee said.

Outlook: Steady Growth Into 2026

The data comes as the Reserve Bank prepares for its Melbourne Cup Day meeting, where rates are expected to remain on hold at 3.6 per cent.

With inflation easing only gradually and unemployment sitting around 4.5 per cent, analysts expect monetary policy to stay steady for now.

Ray White’s forecast suggests 2025 will close with high single- to low double-digit annual growth nationally, with smaller capitals and regional areas tipped to outperform well into 2026.

Micro-needling promises glow and firmness, but timing can make all the difference.

An opulent Ryde home, packed with cinema, pool, sauna and more, is hitting the auction block with a $1 reserve.