Sydney’s priciest streets widen the gap in Australia’s luxury market

Ray White senior data analyst Atom Go Tian says Sydney’s elite postcodes are pulling further ahead, with Bellevue Hill dominating the nation’s most expensive streets in 2025.

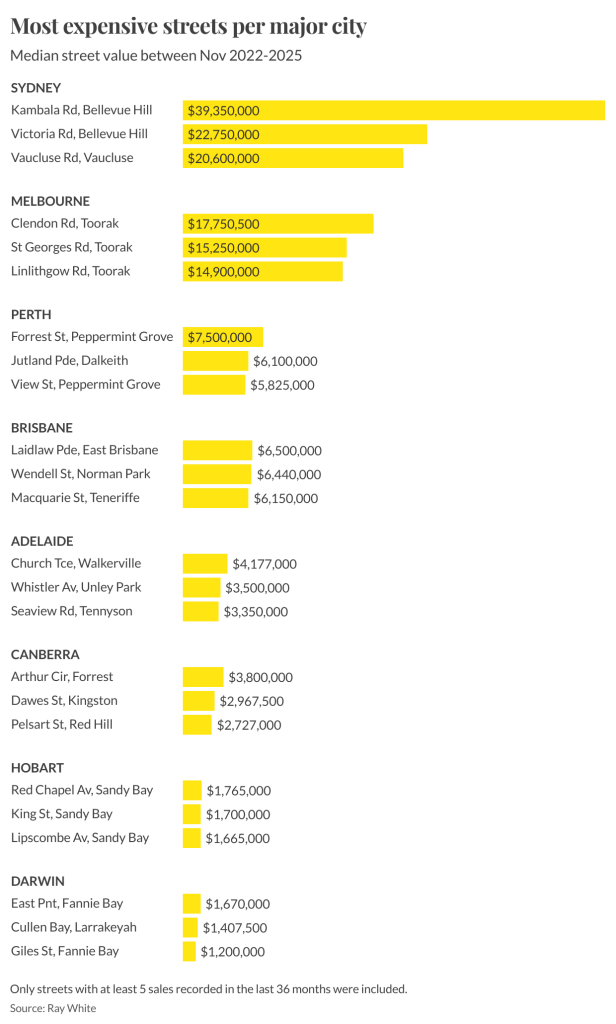

Sydney has cemented its status as the nation’s luxury capital, with Kambala Road in Bellevue Hill being Australia’s most expensive street this year, posting a median house price of $39.35 million.

And, according to Ray White senior data analyst Atom Go Tian, last year’s leader, Wolseley Road, was excluded from this year’s rankings due to limited sales.

“Wolseley Road recorded only three sales this year and was therefore excluded from the rankings, though its $51.5 million median would have otherwise retained the top position,” he says.

Bellevue Hill continues its dominance, accounting for six of the nation’s top 10 streets. Tian says the suburb’s appeal lies in its rare blend of location and lifestyle advantages.

“The suburb’s enduring appeal lies in its rare combination of proximity to both the CBD and multiple beaches, harbour views, and large estate-sized blocks on tree-lined streets.”

Vaucluse remains a powerhouse in its own right. “Vaucluse extends this harbourside premium with even more direct beach access and panoramic water views,” he says.

The gulf between Sydney and the rest of the country remains striking.

According to Tian, “Sydney’s most expensive streets are more than five times more expensive than the leading streets in Perth and Brisbane, and more than 10 times the premium streets in Canberra and Adelaide.”

He attributes this to Sydney’s economic role and geographic constraints, describing it as “Australia’s financial capital and its most internationally connected city.”

Beyond Sydney, each capital city has developed its own luxury hierarchy. Tian highlights Melbourne’s stronghold in Toorak, noting that “Melbourne’s luxury market remains centred around Toorak, led by Clendon Road, St Georges Road and Linlithgow Road.”

Brisbane’s prestige pockets are more dispersed: “Brisbane’s luxury real estate shows a more diverse pattern,” he says, led by Laidlaw Parade at $6.5 million. Perth’s top-end market remains anchored in the Peppermint Grove–Dalkeith corridor, with Forrest Street at $7.5 million.

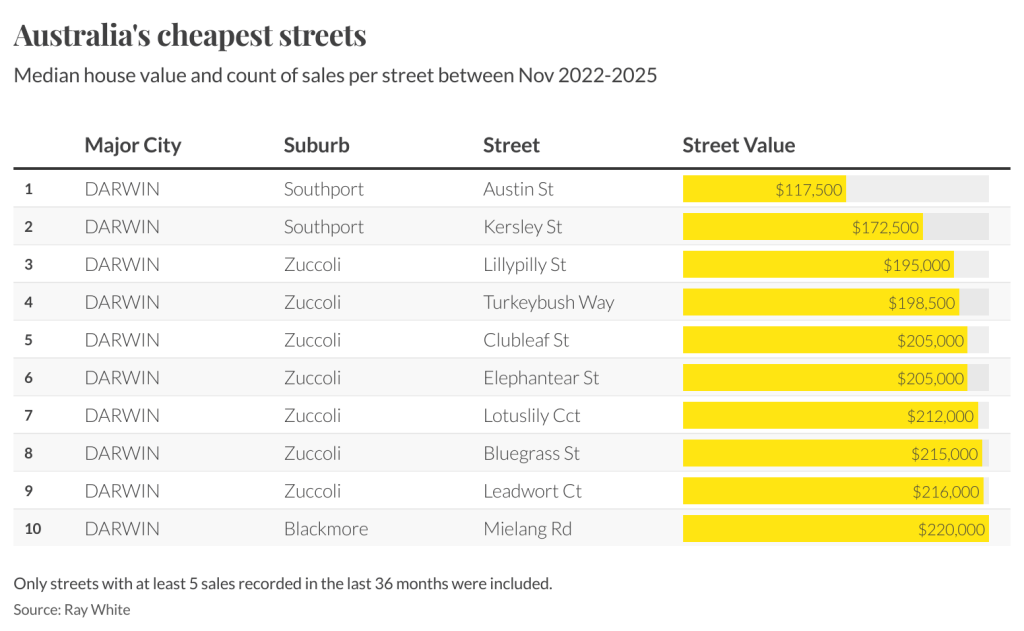

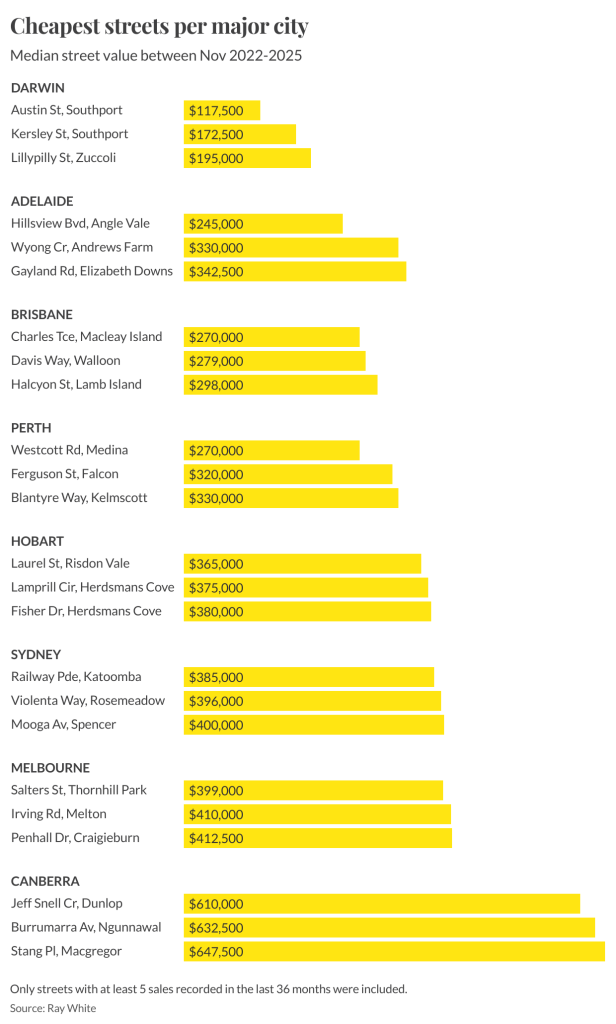

He also points to the stark contrast at the lower end of the spectrum. “Darwin presents a mirror image, hosting all 10 of the country’s cheapest streets,” Tian says. Austin Street in Southport sits at just $117,500.

The national spread reaches its extreme in New South Wales. “Sydney emerges as the most polarised market, spanning an extraordinary range from Railway Parade in Katoomba at $385,000 to Kambala Road’s $39.35 million,” Tian says.

Methodology: Tian’s analysis examines residential house sales between November 2022 and November 2025, with only streets recording at least five sales included. Several streets with higher medians, including Black Street, Queens Avenue and Clairvaux Road in Vaucluse, were excluded because they did not meet the sales threshold.

A resurgence in high-end travel to Egypt is being driven by museum openings, private river journeys and renewed long-term investment along the Nile.

In the lead-up to the country’s biggest dog show, a third-generation handler prepares a gaggle of premier canines vying for the top prize.

The new Brooklyn Tower, a mix of luxury condos and rentals, rises from the historic Dime Savings Bank building.

Listing of the Day

Location: Downtown Brooklyn, New York

Price: $16.75 million

Boasting 360-degree panoramic views across New York City, this new 92nd-floor penthouse is the highest residence in Brooklyn.

The full-floor apartment stands atop the new Brooklyn Tower, which encompasses 143 condos and 398 rentals in the heart of downtown Brooklyn, said Katie Sachsenmaier, senior sales director, Corcoran Sunshine Marketing Group.

The condos begin on the 53rd floor, and the penthouses begin on the 88th floor. This one, Penthouse 92, is the only full-floor penthouse.

“The building is coming into its own now,” she said. “It feels very busy when you step into the lobby.”

Developed by Silverstein Properties, the building at 85 Fleet Street rises from the historic Dime Savings Bank building, according to a news release.

It was designed by SHoP Architects with interiors curated by Gachot Studios, and it is the borough’s only super tall skyscraper.

Penthouse 92 features custom interiors by Brooklyn-based Susan Clark of design firm Radnor, Sachsenmaier said. “Her selections have made it really beautiful. It feels very warm and inviting.”

Architectural details include 12-foot ceilings, European white oak floors in a custom honey stain, mahogany millwork, bronze detailing and floor-to-ceiling windows.

The eat-in kitchen features Absolute Black stone countertops, an island with seating, oil-rubbed bronze Waterworks fixtures and integrated Miele appliances, according to the listing.

The primary en suite bathroom showcases large-format Honed Breccia Capraia marble. There is also a separate laundry room as well as a wet bar and a butler’s pantry.

The views are spectacular, Sachsenmaier said. “If you’re standing in the living room, you take in the Statue of Liberty and all the way up through Midtown. On a clear day, you can see the planes take off at LaGuardia (Airport).”

Photo: Sean Hemmerle

Moving around the apartment, you see south over the harbor and then north and east over the whole city, she said.

From the front door, “you’re immediately greeted with the expansive living room and the view,” she said. “It’s really the first thing you see.”

The primary suite features a dressing room, multiple walk-in closets, two bathrooms (one with a cedar sauna) and southwest-facing windows, Sachsenmaier said. “You get those really beautiful harbour views.

The amenities will be ready by the end of summer, she said. A Life Time club will occupy the entire sixth and seventh floors, and an outdoor pool deck wraps around the dome of the bank building.

Stats

The 5,891-square-foot home has four bedrooms, five full bathrooms and one partial bathroom.

Amenities

Residents will have access to over 100,000 square feet of exclusive indoor and outdoor leisure spaces.

Fitness company Life Time will manage an array of amenities that include a 75-foot indoor lap pool, outdoor pools, a poolside lounge and atrium, a billiards room, a library lounge, a conference room, a theatre with a wet bar, a children’s playground and playroom and limited off-site parking.

The Sky Park offers an open-air loggia with a basketball court, foosball, a playground and a dog run.

Photo: Gabriel Saunders

Neighbourhood Notes

Downtown Brooklyn is at the centre of a number of neighbourhoods, including Fort Greene, Cobble Hill, Boerum Hill and Brooklyn Heights. The tower has access to 13 subway lines, 11 commuter trains, the city’s ferry network and 22 Citi Bike stations.

“You can walk to Fort Greene Park in less than 10 minutes,” and Dekalb Market Hall, which has a Trader Joe’s, a Target and a food hall, is “right next door,” Sachsenmaier said.

Agent: Katie Sachsenmaier, senior sales director, Corcoran Sunshine Marketing Group

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?