The faster pathway to building wealth is no longer how much you earn, investors believe

A new survey reveals almost half Australian investors think the route to achieving their financial goals is not through wages

Almost one in two Australian investors believe what they own is more important than how hard they work and the income they earn for building wealth, according to a survey of more than 2,000 investors conducted by online trading platform Stake. This attitude reflects the fact that house prices have risen faster than wages for many years, according to Stake CEO, Jon Howie.

“In Australia, over the past 30 years, house prices have risen by an average of 8 percent per annum, compared to around 3 percent for wages, and it’s a similar story in New Zealand,” Mr Howie said.“Given the property market’s increasing barriers to entry, people are looking for other routes to building wealth. Rather than simply waiting for things to get better, they are upskilling, delaying gratification and engaging with financial markets to supplement their hard work.”

Investors cited slow wage growth as among the three biggest barriers to achieving their financial goals. Almost one in four investors expect no increase to their salary this year, or even a decrease, amid early signs that the labour market is loosening. While the overall unemployment rate remains low at 4 percent, Australian Bureau of Statistics figures released this week show there are 1.9 million people who would like to work but can’t find a job and 1.7 million workers who would like more hours.

Mr Howie said the survey results demonstrated a longer-term shift in our economy and the mindset of investors. “… the traditional blueprint to achieving financial security – namely getting a ‘good job’ and buying property – is not as accessible or reliable as it once was,” he said.

Rapidly rising house prices have made property ownership unattainable for some investors, with only 11 percent of survey respondents ranking real estate as the most accessible asset class for building wealth.

While investors are cutting back on discretionary spending to cope with today’s higher costs of living, about 75 percent are still putting some of their income into investments. The most common amount was 1 to 5 percent of their salary. Younger people have been the most active over the past six months, with 85 percent of 18 to 24-year-olds buying assets during this period. One in five investors said they intended to spend their stage three tax cut savings buying shares.

The survey revealed the five biggest motivations for Australian investors, starting with retiring and living off their investments; and supplementing their wage or salary with investment income. The next biggest motivations were funding holidays and travel, cutting back on hours and buying a home.

Australian investors have various definitions of financial success. More than 85 percent said being debt-free and owning their own home were the two most important financial achievements. Other definitions included being able to live in the neighbourhood they want (77 percent) and having the capacity to help family members (75 percent).

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Australian house prices are surging again, delivering double-digit annual growth months ahead of schedule.

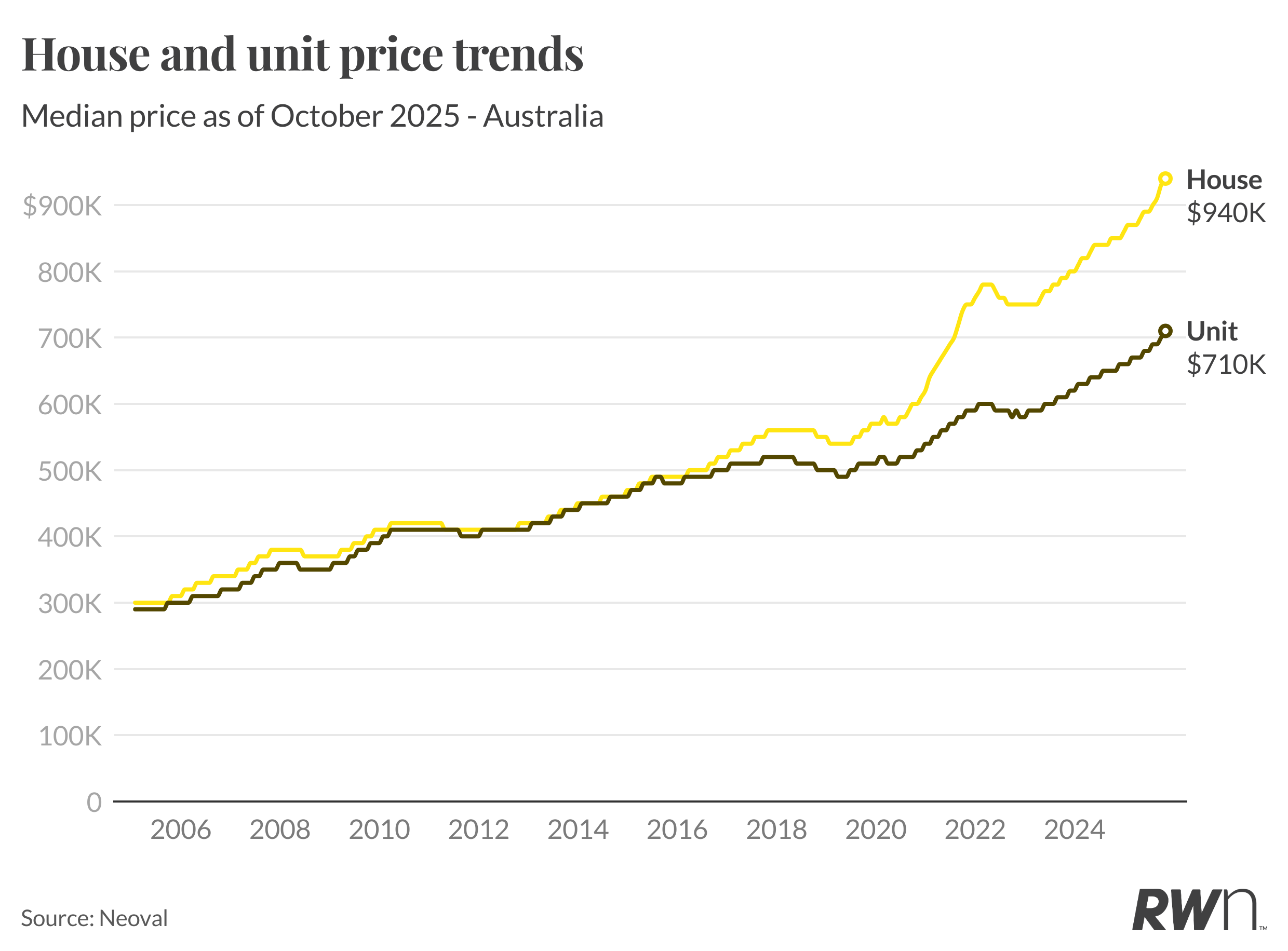

Nationally, the median house price climbed 1.1 per cent in October to $940,000, lifting annual growth to 10.6 per cent, the first double-digit increase since the 2021–22 property boom.

Market Resilience Surprises Analysts

The acceleration comes earlier than expected, according to Ray White Group Chief Economist Nerida Conisbee, who says the milestone was originally forecast for the end of the year.

“Stronger-than-expected October gains and continued tight supply across most markets have pushed growth ahead of schedule,” Conisbee said. “This shows how resilient demand has remained through spring.”

Perth (+14.8 per cent), Brisbane (+12.5 per cent) and Adelaide (+10.8 per cent) continue to lead the charge among capital cities, while Sydney (+8.6 per cent) and Melbourne (+6.5 per cent) show steady, consistent increases.

Regional Markets Extend Their Lead

Beyond the capitals, regional Australia is powering ahead, particularly in the resource states.

Regional Western Australia jumped 16.4 per cent year-on-year, and regional Queensland followed close behind at 14.5 per cent, as population growth and affordability continue to drive demand.

Units Outperform Houses

Unit prices rose even more sharply in October, up 1.4 per cent to $710,000, marking 9.2 per cent annual growth. Conisbee said affordability pressures, new first home buyer incentives, and a lack of available stock are pushing more buyers into the apartment market.

“Units are now seeing stronger monthly gains than houses, reflecting both affordability constraints and renewed first-home-buyer activity,” she said.

The biggest monthly jumps were in Perth (+1.6 per cent), Adelaide (+1.5 per cent), and Brisbane (+1.4 per cent). Melbourne’s unit market also firmed, up 1.6 per cent, as buyers returned to lower price brackets.

Spring Demand Defies Higher Listings

Despite an influx of spring listings, new stock has failed to match the intensity of buyer demand. Nationally, house prices have now risen every month since February, and unit prices every month since March.

“The pace of growth shows demand hasn’t been dampened by higher supply,” Conisbee said.

Outlook: Steady Growth Into 2026

The data comes as the Reserve Bank prepares for its Melbourne Cup Day meeting, where rates are expected to remain on hold at 3.6 per cent.

With inflation easing only gradually and unemployment sitting around 4.5 per cent, analysts expect monetary policy to stay steady for now.

Ray White’s forecast suggests 2025 will close with high single- to low double-digit annual growth nationally, with smaller capitals and regional areas tipped to outperform well into 2026.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

From mud baths to herbal massages, Fiji’s heat rituals turned one winter escape into a soul-deep reset.