THE WALDEN HITS $103 MILLION IN SALES WITHIN THREE HOURS AT NORTH SYDNEY LAUNCH

More than half of Stage One was exchanged on opening day as buyers chase harbour views, amenity and metro connectivity at 177 Walker Street.

North Sydney’s apartment market notched another milestone with the launch of The Walden, where 55 per cent of the Stage One release exchanged contracts totalling $103 million within three hours of sales opening. The project is by ALAND, a gold star iCIRT rated developer and builder.

Positioned at 177 Walker Street on the eastern edge of the CBD, The Walden fronts uninterrupted harbour views from the Sydney Harbour Bridge to Sydney Heads.

Limited local housing supply, strong demand from affluent downsizers and a growing population are cited as drivers of both interest and pricing in the suburb.

Data referenced in the release notes North Sydney apartment prices rose nearly 10 per cent in the 12 months to August 2025, compared with an average year to date gain of 0.7 per cent across wider Sydney. The precinct continues to benefit from public and private investment as it evolves into an 18 hour destination.

“It’s clear that North Sydney’s changing rapidly, and property buyers are excited both by what’s on offer in the suburb now, as well as what’s yet to come,” ALAND Founder Andrew Hrsto said.

“Against this backdrop, The Walden is set to become a benchmark for luxury living in North Sydney, and it’s perfectly poised for buyers to capitalise on the continued growth and transformation in the local area. With its unrivalled amenities, refined design, and rare balance of sophistication and community connection, The Walden delivers a lifestyle unlike anything else on the market.”

Planned resident facilities include a fully equipped gym, wellness and treatment room, spa, wine cellar, residents’ lounge, private dining room, pool, dedicated work from home and meeting spaces, plus concierge services.

“Apartment sales in North Sydney have remained robust throughout 2025, and today’s opening sales at The Walden reflect strong buyer confidence in the area’s ongoing revitalisation,” said Ben Stewart, Partner at SRM Residential, which is overseeing sales.

He added that purchasers are responding to apartment scale and amenity, along with metro connectivity that places Barangaroo three minutes away and Martin Place five minutes away.

“The Walden has the best views in this part of the North Shore which can never be built out, with 70% of apartments enjoying front row views of the harbour.”

Stewart also pointed to confidence in delivery and quality. “The design and sizing of apartments at The Walden is a level above the majority of other projects on the market, and we’re seeing buyers prioritise well designed apartments that offer both lifestyle appeal and long term investment potential.

“ALAND’s 23 years of delivery success, backed its Gold Star iCIRT rating and Latent Defect Insurance (LDI) have been embraced by this market.”

Construction is scheduled to commence in early 2026, with completion targeted for 2028.

Formula 1 may be the world’s most glamorous sport, but for Oscar Piastri, it’s also one of the most lucrative. At just 24, Australia’s highest-paid athlete is earning more than US$40 million a year.

From gorilla encounters in Uganda to a reimagined Okavango retreat, Abercrombie & Kent elevates its African journeys with two spectacular lodge transformations.

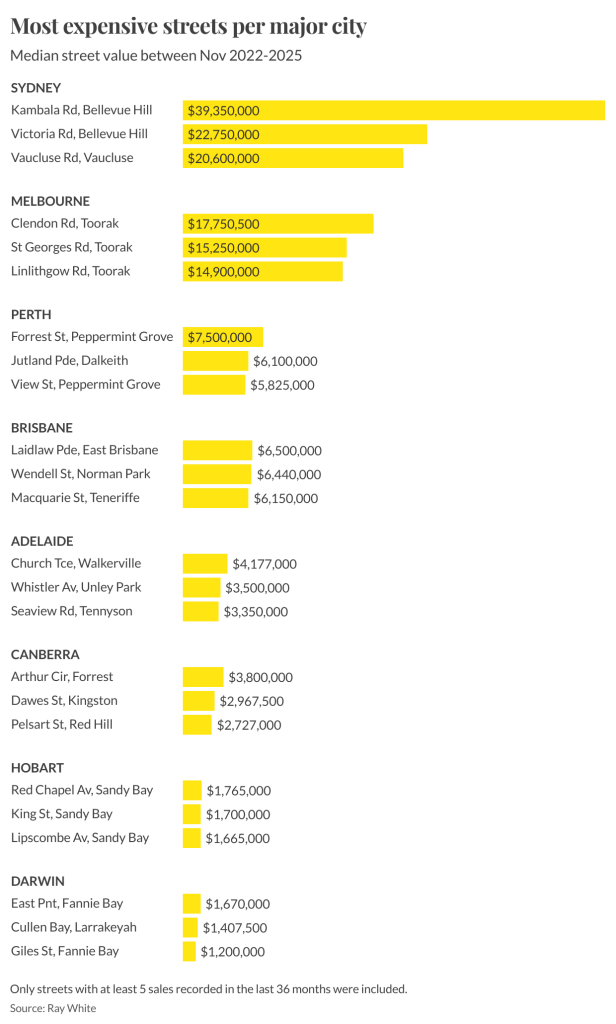

Ray White senior data analyst Atom Go Tian says Sydney’s elite postcodes are pulling further ahead, with Bellevue Hill dominating the nation’s most expensive streets in 2025.

Sydney has cemented its status as the nation’s luxury capital, with Kambala Road in Bellevue Hill being Australia’s most expensive street this year, posting a median house price of $39.35 million.

And, according to Ray White senior data analyst Atom Go Tian, last year’s leader, Wolseley Road, was excluded from this year’s rankings due to limited sales.

“Wolseley Road recorded only three sales this year and was therefore excluded from the rankings, though its $51.5 million median would have otherwise retained the top position,” he says.

Bellevue Hill continues its dominance, accounting for six of the nation’s top 10 streets. Tian says the suburb’s appeal lies in its rare blend of location and lifestyle advantages.

“The suburb’s enduring appeal lies in its rare combination of proximity to both the CBD and multiple beaches, harbour views, and large estate-sized blocks on tree-lined streets.”

Vaucluse remains a powerhouse in its own right. “Vaucluse extends this harbourside premium with even more direct beach access and panoramic water views,” he says.

The gulf between Sydney and the rest of the country remains striking.

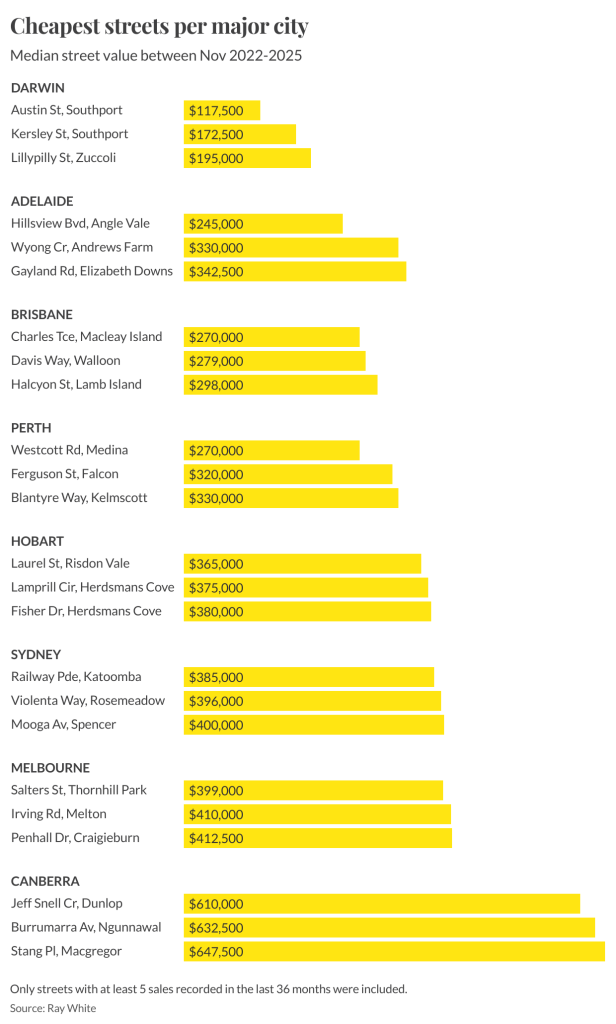

According to Tian, “Sydney’s most expensive streets are more than five times more expensive than the leading streets in Perth and Brisbane, and more than 10 times the premium streets in Canberra and Adelaide.”

He attributes this to Sydney’s economic role and geographic constraints, describing it as “Australia’s financial capital and its most internationally connected city.”

Beyond Sydney, each capital city has developed its own luxury hierarchy. Tian highlights Melbourne’s stronghold in Toorak, noting that “Melbourne’s luxury market remains centred around Toorak, led by Clendon Road, St Georges Road and Linlithgow Road.”

Brisbane’s prestige pockets are more dispersed: “Brisbane’s luxury real estate shows a more diverse pattern,” he says, led by Laidlaw Parade at $6.5 million. Perth’s top-end market remains anchored in the Peppermint Grove–Dalkeith corridor, with Forrest Street at $7.5 million.

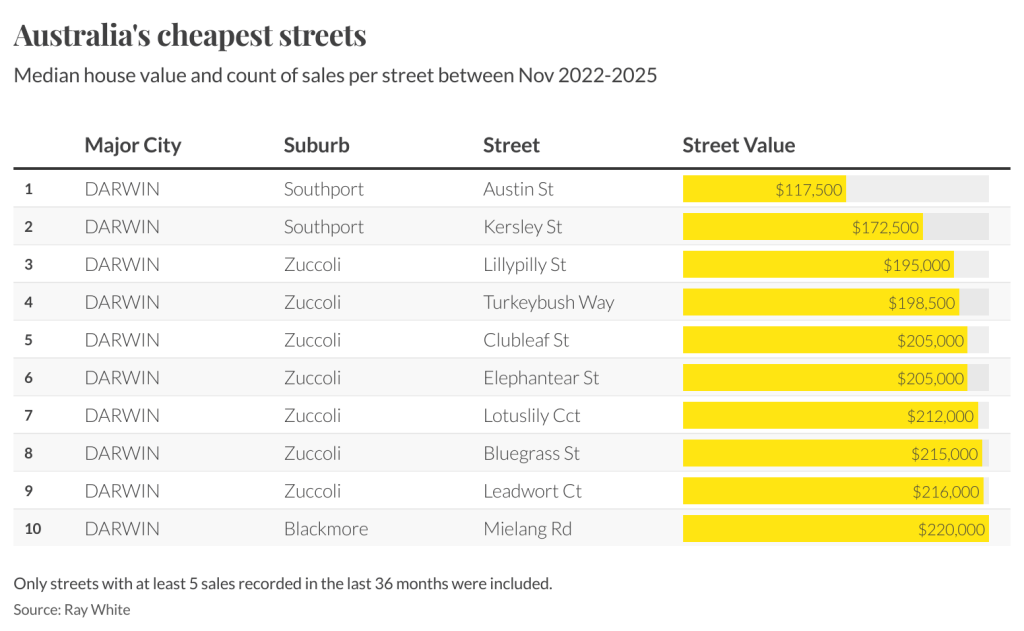

He also points to the stark contrast at the lower end of the spectrum. “Darwin presents a mirror image, hosting all 10 of the country’s cheapest streets,” Tian says. Austin Street in Southport sits at just $117,500.

The national spread reaches its extreme in New South Wales. “Sydney emerges as the most polarised market, spanning an extraordinary range from Railway Parade in Katoomba at $385,000 to Kambala Road’s $39.35 million,” Tian says.

Methodology: Tian’s analysis examines residential house sales between November 2022 and November 2025, with only streets recording at least five sales included. Several streets with higher medians, including Black Street, Queens Avenue and Clairvaux Road in Vaucluse, were excluded because they did not meet the sales threshold.

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.